A study of US pet owners on how and where they shop for petfood offers some interesting insights for professionals in charge of petfood marketing and packaging design, perhaps even for large companies that have the resources to conduct their own consumer research. For example, did you know that the more detail and amount of text accompanying a health claim on a petfood label, the more credible that claim is perceived to be -- even among consumers who say they don't spend much time reading petfood packaging?

The study, conducted by Shikitani LaCroix, a design agency based in Toronto, Ontario, Canada, included an online questionnaire of 545 US consumers, recruited to ensure they represented the entire country and that each owned at least one dog or one cat and did at least some of the petfood shopping for their households (with 65% doing all of such shopping). So the data should carry a little more weight than that deriving from a survey distributed or answered randomly online.

The agency said the demographics of respondents were 59% female, 41% male; average age 45-54; average income US$30,000-$50,000; 65% had no children in the household; 68% completed at least some college or university; 70% owned at least one dog (29% small dogs, 31% medium dogs and 23% large dogs); 58% owned at least one cat. (Note that the study was released by the agency's Design Lounge content portal via a video webinar; unfortunately, it's not clear if you can register to watch it on demand.)

Among the data highlighted was a juxtaposition of where the respondents shop for petfood with how much they reported reading health information on petfood packaging. While none of this data is surprising, necessarily, it does highlight the relationships between retail channels, the type of shoppers they attract and the type of products those shoppers seek. For instance, 18% of respondents said they thoroughly read all health information on a pefood package (including seeking a "credible/scientific look" to the packaging); of those people, 37% frequently purchase petfood from a pet store or independent retailer, while 18% frequently purchase from a grocery or major retail store. (The study didn't define what "major retail store" means, though it did seem to have a separate category for "major pet food chain.")

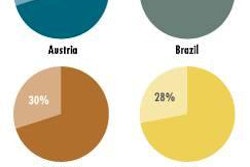

Conversely, 30% of respondents said they rarely or only sometimes notice health information on a petfood package; of those, 28% frequently make their purchases at a grocery or major retail store while 18% do so at a pet store or independent retailer. In the middle were 25% of respondents who said they look for key health words or symbols and 27% who usually read most health information; retail channel preferences were not called out for those two groups.

What the study illustrated about consumer perceptions of the comprehension and credibility of petfood label claims might be of most interest to petfood marketers, especially since it shows you may have your work cut out for you. Only 43% of respondents said they mostly understand health claims and consider them while purchasing petfood; 30% said they understand only basic health claims. Yet, 54% rated ingredient claims as credible or highly credible, 57% rated functional claims as credible or highly credible and 65% rated the claim of "complete and balanced nutrition" as credible or highly credible. I guess it's a good thing the credibility ratings are higher, but you have to wonder how much, well, credibility those ratings have if they're not accompanied by high comprehension.

What, specifically, lends credibility to a petfood package? According to these consumers, a claim of "veterinarian recommended" certainly does, followed by a "100% guaranteed" claim. To probe that further, the study included another section, in which respondents were randomly presented with two of six mock packages, varying in their design in terms of type of visuals (simple to complex), amount of copy (one to four claims), amount of visuals (ingredient imagery, health symbols) and whether the package had a vet recommended claim.

Interestingly, none of the mock packages included photos of the product itself, which respondents said would be important elements to support credibility. They also reported:

- Packaging that did not have enough information was perceived to be unhealthy

- Packaging with a combination of copy and imagery had a higher purchase likelihood rating than packaging with only copy or only imagery

- Detailed information gave packaging credibility

- The most complex packaging with four claims and ingredient imagery was perceived to be the healthiest