Last week's big news that Mars Inc. had agreed to buy 80% of Procter & Gamble's petfood business was and wasn't a surprise. Everyone new P&G was eager to sell its petfood brands (Iams, Eukanuba and Natura); CEO A.G. Lafley said as much over six months ago, when he told analysts the company was looking to off-load its under-performing business units. While he named no specific units at the time, he did say it would involve products that, combined, represented less than 10% of P&G's sales, and that definitely included the petfood brands.

The surprise came from the name of the buyer. Many in our industry (including me, I admit) had assumed the top suitor for the P&G petfood brands was Big Heart Pet Brands, the company formerly known as Del Monte. It had made a number of big moves last year and into this year – including buying Natural Balance Pet Foods, divesting its human foods business to focus on pet care and renaming the company accordingly – that led to widespread speculation it was on the hunt for more petfood acquisitions, including the big prize, the P&G business. (Maybe the two companies had been in negotiations that just didn't work out?)

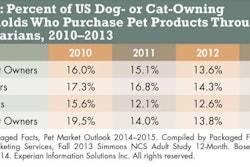

The other part of the surprise lies in the question, what’s in this for Mars? Yes, as most news reports suggested, it solidifies the company’s hold on the top spot for global petfood leaders; now it will edge out Nestlé Purina PetCare by several percentage points, rather than just a decimal point. (Euromonitor’s latest data, for 2012, had Mars’ share of the global petfood market at 23.4%, while Nestlé’s was 23.1% and P&G’s was 4.4%.)

Perhaps the real movement Mars will enjoy will be in the US, where Nestlé owns far more of the petfood market – 35.4% vs. only 14.6% for Mars. P&G’s US petfood share, meanwhile, is 8.8%, so adding that helps Mars start to close the gap between its and Nestlé’s US sales.

This move will also help Mars move into categories where it has lower to no presence: premium/superpremium and natural petfoods. While its Royal Canin business is a strong player in the premium space, adding Eukanuba will only help; and on the natural side, the Natura brands will give Mars a foothold in a category where it currently doesn’t really play at all. (Side note: If the P&G acquisition of Natura caused concern among independent pet retailers and others in the industry that those brands would no longer be true "pet shop" brands, can you imagine the level of hysteria this latest sale is causing?)

Interestingly, the deal does not include P&G’s Western European petfood business; according to Bloomberg.com, Mars “didn’t want� that business. Perhaps the company knew it might face anti-trust issues there and chose to avoid them completely? No matter what the reasoning, P&G is still seeking a buyer for that business. “We will actively pursue the sale of our pet care business in Europe,� said Paul Fox, a company spokesman (quoted by Bloomberg).

So, who are the most likely suitors for that? Let the next round of speculation begin.