Grain-free pet food now accounts for nearly 30% of pet food sales in the US pet specialty retail channel, as well as four of every 10 new pet food products launched, according to Maria Lange, director of client services and analytics for GfK. With that level of market share, is it safe to say that grain-free pet food is no longer a trend?

Lange presented this data at Petfood Forum 2015 on April 28 in Kansas City, Missouri, USA. Interestingly, when she first proposed her topic, “The next big thing in pet food,” last fall, the accompanying description included this question: Is grain-free pet food yesterday’s news? Lange answered her own question last week with an emphatic no.

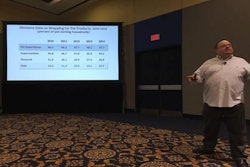

While growth of grain-free pet food sales in US pet specialty retail has slowed somewhat from nearly 42% in 2012 and 31.5% in 2013, it still hit almost 24% in 2014, adding up to a total of US$2.2 billion sold in US pet stores (both chains and independent shops). Within that sales number, grain-free pet treats are still increasing at a 40.5% clip, Lange said.

What’s more, grain-free is now driving continued growth in the natural pet food category, she emphasized. Sales of natural pet food with grain-based ingredients actually declined slightly (-2.3%) in 2014, while grain-free natural products increased 23.4%, continuing a three-year pattern. (The slight difference between that sales increase and that of overall grain-free pet foods at 23.9% must mean there are grain-free products not also marketed as natural—rather curious!)

Another high-growth category Lange keyed on in her Petfood Forum presentation was freeze-dried pet food. While frozen and refrigerated pet food products are still growing strongly—nearly 42% for refrigerated in 2014 and 26.6% for frozen—and represent US$108 million in US pet specialty pet food sales, Lange speculated that these products’ growth and sales might have a ceiling due to their high cost (US$4-6 per pound), distribution challenges and the need for special storage and display for retailers, along with inconvenience for pet owners.

Freeze-dried pet foods, on the other hand, can be shipped, handled, displayed and stored the same as dry pet food products. This convenience, combined with the appeal of “raw” pet food also shared by frozen and refrigerated products, has the freeze-dried category growing at 43.7% in 2014, Lange said, with full meals at a hearty 60% rise (and freeze-dried treats at 16.8%). Freeze-dried items carried per store increased 15% in 2014, even higher than grain-free at 14%, with nearly 71% of stores in the US pet specialty channel selling freeze-dried products. In all, the category reached US$73.9 million in US pet specialty sales last year.

However—and this is significant—freeze-dried products cost even more than frozen or refrigerated: a whopping US$31 per pound. Will the recent introduction of pet foods combining freeze-dried pieces with dry pet food, lowering the cost to US$4-5 per pound, mitigate that and help this category soar even higher, Lange wondered? The lower cost is still comparable to that of frozen and refrigerated, and well above even the US$2.94 per pound for grain-free pet foods, so I believe that’s still a barrier.

Pet treat spending on the rise

Lange’s data on freeze-dried pet treat sales corresponded with that presented by David Sprinkle, research director for Packaged Facts, who provided an update on the US pet treat market as part of Petfood Innovation Workshop: Next Generation Treats. Sprinkle said his company’s data for 2015 to date showed that 15% of cat owners and 12% of dog owners had purchased freeze-dried treats.

Other treat data of note:

- Treats account for 16% of US pet share spending, even more than value (economy) priced pet food, which is at only 12%. (Premium pet food has a 42% share, and “regular” pet food, which presumably falls somewhere between economy and premium, 30%.)

- Purchasing of cat treats among US households has risen from 40.2% in 2004 to 46.5% in 2014. Dog treat purchasing has remained fairly steady (and still much higher): 77.2% in 2004 and 78.1% in 2014.

- The cat treat growth trends carry over to the US mass market channel, which showed a 7.7% sales increase and 10.2% volume increase in 2014. For dog treats, mass market sales grew 6.4% but volume was flat (0.5% increase).

- These numbers are reflected in monthly pet treat spending by cat owners vs. dog owners: 28% of cat owners spend less than US$5 per month on cat treats, with another 28% spending US$5-9. With dog treats, while 26% of dog owners spend US$5-9 a month, another 25% spend US$10-19; amounts of US$20-29 and US$30+ per month account for 17% each.

- Most pet owners (77% of dog owners and 56% of cat owners) buy regular pet treats, though dog owners are also turning to dental chews (36%), rawhide/natural chews (31%) and pet jerky (27%).

- In terms of treat shapes, Sprinkle suggested there may be opportunity for innovation and growth in cat treats, where 65% of cat owners purchase basic bite-sized bits or kibble-like treats. Among dog owners, 47% buy bone-shaped treats, with another 28% buying biscuits or wafer-shaped treats and 29% purchasing sticks.

- In terms of special formulations or label claims, nearly the same proportion of dog and cat owners (64% and 63%, respectively), have used such treats, including claims such as human grade ingredients, grain-free, non-GMO, natural and organic.

- The claim receiving the highest usage level? Made in the USA, at 36% for dog owners and 32% for cats owners.

- Treats are a good way to get pet owners to try new products: for pet nutrition brands studied by Packaged Facts to date this year, 61% of dog owners said they’ve bought new treats in the past six months, and 73% in the past 12 months. For cat owners, the numbers are 57% and 71%, respectively.