Sales of dog and cat food (excluding treats, chews and similar products) in the U.S. reached a projected total of US$27.15 billion in 2018, according to Packaged Facts’ latest report, “Pet Food in the U.S., 14th edition.” That total represents a nearly 4.3 percent year-over-year increase, a solid growth rate.

Yet the market research firm’s analysts caution that growth will slow – down to 3 percent, then 2 percent a year – by 2023. Much of the current growth is coming from e-commerce sales, they said, which now accounts for 17 percent of the U.S. pet food retail market. That growth, while helping lift the entire market to an increase, came at the expense of traditional brick-and-mortar pet stores.

The analysts’ concern comes mainly from three countervailing trends in the marketplace: the U.S. pet population is steady, not necessarily growing; most pet owners have already upgraded to premium or superpremium pet foods, whose higher prices help make up for flat or declining volume sales; and at the same time, many premium and similar pet food brands have gone mass market, which tends to mean lower prices.

However, hope for continued healthy growth may lie in U.S. consumer spending numbers from 2017. Yes, those data are a full year older, and spending is not necessarily the same as retail sales (though, by nature, they track closely). What’s promising is which groups are spending more on pet food, according to an in-depth analysis by John Gibbons, the self-proclaimed Pet Business Professor.

Upgrading to premium pet food more viable for more consumers

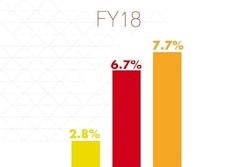

In 2017, consumer pet food spending (including on treats) hit U.S. $31.1 billion, a 4.6 percent increase over 2016 spending, according to the U.S. Bureau of Labor Statistics (BLS). Breaking down the data, Gibbons looked at spending by various demographics, including age, race, household income and ownership, number of people in the household, occupation, area and education.

His analysis offers many interesting points and insights, but the reason for optimism arises from this: previous, similar, year-over-year increases, such as in 2015, came about because of a certain portion of consumers upgrading to superpremium pet foods – as Packaged Facts also indicated. For the most part, these consumers were better educated, had manager-level jobs (or were self-employed) and higher incomes, Gibbons said.

Yet, 2017’s growth was different, partially due to mass premiumization.

“There was an extremely competitive environment with increased availability and value everywhere on these high-quality foods,” he wrote. “This attracted the attention of a different group of consumers. The benefits of upgraded food were apparent to most pet parents; now they became a viable option for a much larger group. The upgrade ‘epidemic’ spread to high school graduates with some college education, blue-collar workers and even to low middle-income groups. It also primarily ‘infected’ those 35 and over, especially 55-to 65-year-olds.”

While that last demographic group may not portend as much hope for future pet food growth – after all, no one can live forever, and pet ownership tends to decline among aging consumers – these other rising groups do offer promise. Pet food spending in 2017 did increase among the groups typically known for driving growth, such as managers/professionals and consumers with advanced college degrees, Gibbons explained, but not only them. “It was primarily driven by more balanced spending in a number of demographic categories.

“Income, home ownership and marriage remain the most important factors in pet food spending,” he continued. “However, the amount of necessary income has been dialed back and your occupation and the number of earners in the consumer unit (household) has become far less important. Higher education has also become less of a factor.”

And one more trend worth noting: Pet food spending among consumers in rural areas and suburbs with a population less 2,500 also had a strong year.

U.S. pet ownership rising?

None of this is a guarantee that spending growth will continue or even that it continued in 2018 – full numbers from BLS are not yet available. (The U.S. government typically moves slowly, likely even more so now because of the shutdown!) Yet unlike Packaged Facts, Gibbons cites increasing pet ownership rates, according to data from the American Pet Products Association. Its most recent survey showed pet ownership among 68 percent of U.S. households in 2017, up from 65 percent in 2015.

Even if the rate of ownership grows only slightly, if more of those owners are spending more on pet food, that bodes well for the market.