Global poultry trade is expected to expand by 2% in 2025, reaching a new high of 13.8 million tons. Growth in the global economy is expected to be higher in 2025 than in 2024, albeit only slightly, and inflation is expected to continue to ease, both positive factors that should contribute to higher consumer demand.

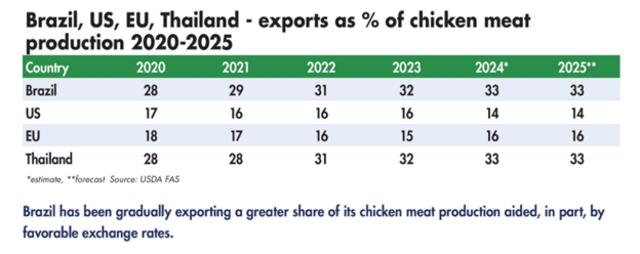

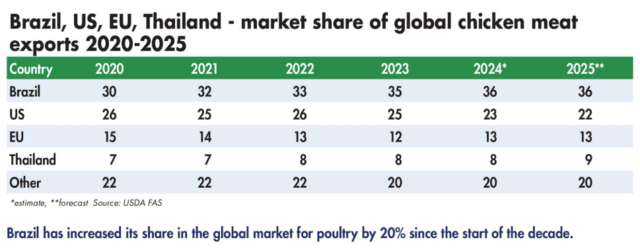

All major exporters are expected to record gains, but it will be Brazil that records the most successes over the year ahead, believes the U.S. Department of Agriculture (USDA) Foreign Agricultural Service (FAS).

Brazil exports to keep rising

Brazilian chicken meat exports have been on an uninterrupted upward trend since 2018. Over the first 11 months of 2023, for example, exports rose by 3.7%, reaching 4.84 million metric tons. By value, they rose by 1%, according to figures released by industry association the Brazilian Association for Animal Protein (ABPA).

The long-term outlook for Brazilian exports strengthened significantly in early December 2023 with the signing of the EU-Mercosur partnership agreement, boosting trade and political ties between the two blocs. The agreement contains a new chicken meat export quota of 180,000 metric tons of carcass weight with zero tariffs for the members of Mercosur, which comprises Argentina, Bolivia, Brazil, Paraguay and Uruguay. The quota will be gradually introduced over six years, then applied annually.

Ricardo Santin, ABPA president commented that the agreement opened new opportunities for shipments to Europe under better conditions than those now in place. Current quotas would be maintained, he continued, and the new quotas used primarily for Brazilian product. Over the 11 months to November 2023, Brazilian chicken meat exports to the EU reached 205,000 metric tons, worth US$749.2 million.

In December 2024, the ABPA forecast that exports in 2025 would increase to 5.4 million metric tons, up by 1.9%.

Commenting earlier in the year, the FAS, a little more optimistically, forecast that Brazilian chicken meat exports would rise by 2% in 2025, with the greatest gains being made in Mexico, Saudi Arabia, Singapore, the United Arab Emirates and the U.K. It continued that Brazilian success in world markets would be primarily at the expense of the EU and the U.S., adding that the Brazilian industry’s success can be attributed to competitive pricing, product offering, the industry’s export orientation, low input costs and its disease status.

The FAS points out that the country continues to maintain its highly pathogenic avian influenza free status, with outbreaks having been limited to wild birds and backyard flocks and with no cases recorded in commercial flocks.

Others to gain from upturn in demand

It will not, however, only be Brazil that gains the increasingly positive economic outlook – all major exporters are expected to see an upturn this year.

Improving disease status will also play a part in the EU’s expected increase in poultry exports this year, with restrictions gradually being lifted. Over 2024, the European Commission believes that exports were 3% higher and a similar figure is expected for 2025.

U.S. exports are expected to rise by 1% this year, reaching 3.1 million tons, particularly driven by demand from Canada and Mexico.

Thailand’s exports will be supported by growth in demand for cooked chicken, particularly from the EU, Japan and the U.K., and its sanitary status, with the country not having experienced an outbreak of HPAI since 2009, will also act in its favor. Like Brazil, Thailand’s exports are expected to reach a new record this year.

Improving outlook

Trade in 2025 will build on the strengthening that occurred during 2024. In September last year, Rabobank noted that it expected international demand for chicken to remain strong throughout the second half of the year, however, it noted that some traditional importers were facing weak market conditions and oversupply

The global economy this year has been described as "resilient." In its December 2024 forecast, the Organisation for Economic Co-operation and Development (OECD) noted that growth in the global economy in 2025 and 2026 would be 3.3%, slightly up on 2024’s expected 3.2%. It added that headline inflation was not back to central bank targets in most economies.

It cautioned, however, that persistent uncertainties remained, for example conflict in the Middle East, and warned that trade tensions also risked hampering growth.

Brazilian exports and production

The pace of growth in Brazilian exports could be slightly lower in 2025, according to local industry body the Brazilian Association of Animal Protein (ABPA).

It believes that by the end of the year, exports, at 5.5 million metric tons, will be 1.9% higher, while in 2024, they are estimated to have risen by 3.1%.

Despite this slight slowdown, the outlook remains positive.

Commenting on the latest forecast, ABPA President Ricardo Santin said: “The Brazilian economic outlooks should protect consumption levels on the home market, helped by the sector’s competitiveness. In overseas markets, we are hoping for new market access in Central America and Asia, broadening the diversity of destinations for our product."

He continued that the industry’s total production in 2024 would stand at 15 million metric tons, up by 1.1% on 2023, while for 2025 it would be 0.3 million metric tons higher, an increase of 2.7%.

Rising by 2.1% higher, 9.9% of production would be sold within Brazil, where per capita consumption is forecast to increase by 2.2% to stand at 46.6 kg.