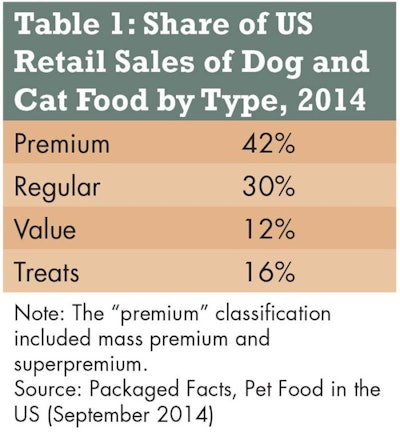

As reported in Packaged Facts’ Pet Food in the US (September 2014), premium petfoods (including mass premium and superpremium brands) accounted for 42% of petfood sales in 2014, followed by regular petfood at 30% and value petfood at 12%, with treats accounting for the remaining 16% share of sales (see Table 1).

Both the leading share for premium petfood and the significant (and expanding) role of pet treats attest to the importance of the pet humanization trend, which has reshaped the petfood industry over the last decades. In the US market, pet humanization is now a given. A recent Packaged Facts consumer survey shows that 56% of pet owners strongly agree that their pets are part of the family, and another 27% somewhat agree (see Table 2). Conversely, and remarkably, only 4% of pet owners actively disagree (whether somewhat or strongly) that pets are part of the family.

As a natural expression of the pets-as-family mindset, pet owners have become highly receptive to products similar to those they use for themselves. Nowhere is this trend more evident than in product formulations and formats for petfoods and treats, given that food is such a personal (and familial) product. The consumer implications of pet humanization, however, extend far and wide, and some are less direct than others.

A vivid if not surprising pattern involves pet pampering behavior. Among consumers who strongly agree that their pets are part of the family, according to Packaged Facts survey data, 43% strongly agree that they enjoy purchasing products that pamper their pets (see Table 3). Among pet owners who only somewhat agree that their pets are family, the figure plunges to 9%. Among pet owners who don’t agree (at either level) that their pets are family, only 2% make a beeline for pet-pampering products.

The same general pattern is evident in demand for natural pet products, at least if they are affordable. Among consumers who strongly agree that their pets are part of the family, 33% strongly agree that they would buy natural or organic products more often if such products were more affordable where they shop. That figure drops to 14% among pet owners who only somewhat agree that their pets are like family and to 6% among pet owners who don’t see pets as family members.

Nearly identical ratios hold when it comes to shopping around for pet products, and to shopping in the pet specialty channel to buy specialty brands. That is, among consumers who strongly agree that their pets are part of the family, 34% strongly agree that they shop for pet products in a variety of stores, compared with 12% of pet owners who only somewhat agree that their pets are like family and to 6% of pet owners who don’t see pets as family.

Very similarly, among consumers who strongly agree that their pets are part of the family, 33% strongly agree that they the shop in pet superstores or pet stores for access to specialty brand products, compared with 14% of pet owners who only somewhat agree that their pets are like family and to 7% of pet owners who don’t grant their pets family status.

Pet humanization attitudes and the quality/price bargains being sought out are therefore framing pet product and retail channel choices. And it’s the pet pamperers who are disproportionately demanding higher quality in petfoods and supplies without, in equal measure, loosening up their purse strings. Among those consumers who strongly agree that their pet is part of the family, 44% strongly agree that they look out for lower prices, special offers and sales on pet products. Among pet owners who don’t see pets as part of the family, that figure falls to 14%.