Pet treats have always been a much-talked-about segment of pet food production. They have yet to gain the market share numbers of pet food for either cats or dogs, for many reasons—they can be seen by consumers as an “extra” in terms of their pets’ nutrition; there are so many options out there that no single type can hope to dominate the treat market; price points can vary quite a bit depending on what type of treat and companion animal manufacturers are aiming for.

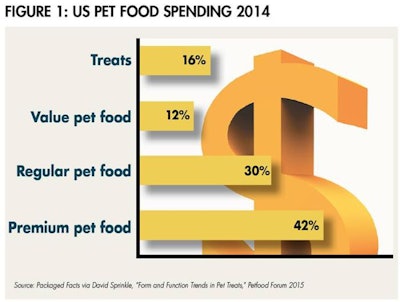

Regardless of these challenges, treats continue to provide a growth opportunity for the pet food market. According to Packaged Facts data (presented by David Sprinkle at 2015 Petfood Forum’s Petfood Innovation Workshop Opening Session, “Form and function trends in pet treats”), in 2014 treats made up 16% of US pet food spending, actually beating out value pet food (12%), though remaining behind regular and premium pet food (see Figure 1).

Pet treats hold a small share of US pet food spending when compared to most pet food; however the 16% treats held in 2014 did beat out value pet food spending.

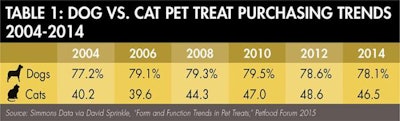

This isn’t to say that pet owners aren’t purchasing treats. In 2004, 77.2% of US dog-owning households purchased treats for their pets, while 40.2% of cat-owning households bought treats for their felines (see Table 1). These numbers fluctuated slightly in both directions between 2004 and 2014, settling on 78.1% of dog-owning households and 46.5% of cat-owning households in 2014. According to IRI multi-outlet retail data on mass-market growth for pet food segments, in 2014 dog biscuits/treats/beverages grew 6.4% in dollar amount and 0.5% in volume, while cat treats grew 7.7% in dollar amount and a significant 10.2% in volume.

The purchase of dog and cat treats by pet-owning households in the US has fluctuated in the last decade, but in the long-term the numbers have increased—from 77.2% to 78.1% of dog-owning households and from 40.2% to 46.5% of cat-owning households.

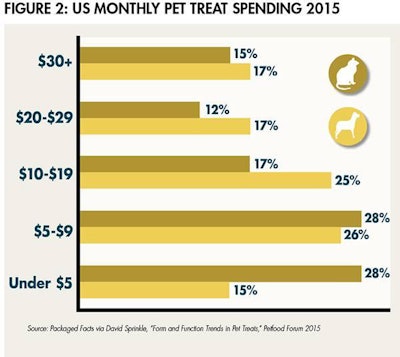

US consumers who purchase treats for their pets fall all over the spending spectrum. According to Packaged Facts data, 28% of cat owners and 15% of dog owners spend less than US$5 per month on treats (see Figure 2). But another 15% of cat owners and 17% of dog owners spend more than US$30 per month. The majority of cat and dog owners, however, spend less than US$20 per month.

While monthly treat spending for pet-owning households varies, the majority of both cat and dog owners say they spend US$19 or less on treats per month.

Overall, consumers say they’re spending more on pet products—a fact which may be an advantage for pet treat manufacturers looking to increase profits. According to Packaged Facts data, 51% of respondents to the statement, “I am spending more on pet products than I used to,” said they somewhat or strongly agree with the statement. Only 19% somewhat or strongly disagreed, with the remaining 31% stating that they neither agreed nor disagreed—suggesting that if those consumers aren’t spending more, they aren’t necessarily spending less, either.

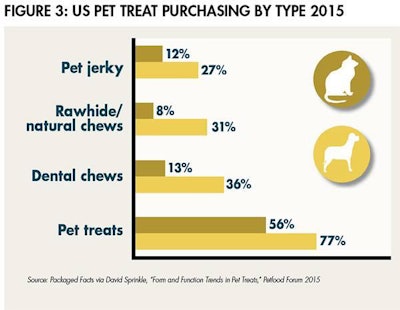

The types of treats being purchased range from jerky to chews to functional treats and beyond. According to Packaged Facts, 12% of cat owners and 27% of dog owners have purchased pet jerky in 2015 (see Figure 3). Eight percent of cat owners and 31% of dog owners gravitate towards rawhide/natural chews, 13% of cat owners and 36% of dog owners purchase dental chews for their pets, and 56% of cat owners and 77% of dog owners have purchased some other type of treat in 2015.

Unsurprisingly, the percentage of cat owners who purchase traditionally dog-centric treats, such as jerky or rawhide, is far smaller than that of dog owners. However, the majority of both cat and dog owners say they have purchased some type of treat for their pets in 2015.

Even the shape of pet treats can play a role in purchasing decisions. According to 2014 Packaged Facts data, 65% of cat owners and 39% of dog owners have purchased bite-size bits/kibble-shaped treats for their pets. That shape is the largest purchase for cat owners, with round/disc/cookie-shaped coming in at a distant second (14%). Dog owners, however, are more varied: 47% of dog owners have purchased bone-shaped treats, 29% have purchased stick-shaped treats and 28% have purchased biscuit/wafer-shaped treats for their pets.

Plenty of pet food companies continue to take up the challenge of profiting in the pet treat market.

Charlee Bear Products’ (www.charleebear.com) grain-free bear crunch dog treats are disc-shaped and are wheat, grain, soy and corn free. A special manufacturing process makes them less dense, offering a calorie-light crunchy treat suitable for training as well as for fun.

Pet Tao LLC (www.pettao.com) offers food therapy Harmony treats and supplements for both cats and dogs. These functional supplements focus on health and include Pork Lung for pets with lung disease and skin allergies; Beef Spleen for pets with vomiting and diarrhea and muscle problems; and Kidney for pets with kidney disease, arthritis and hearing problems.

Courtesy Pet Tao LLC

Pet Tao’s treats and supplements focus on cat and dog health, including varieties to cover a number of ailments such as lung disease, kidney disease, liver disease, allergies and arthritis.

Vets Plus Inc. (www.vets-plus.com) offers gluten-free Smart Fido USA supplements and treats for dogs. The veterinarian-formulated lines include a range of gluten- and soy-free products aimed at overall nutrition, joint and digestive support, calming or skin and coat, and other common conditions.

Addiction Foods LLC’s (www.addictionfoods.com) Awesome Possum treats are suitable for both cats and dogs. These kibble-shaped bites are all-natural, GMO-free and high in omega-3.

Courtesy Addiction Foods LLC

Awesome Possum pet treats are made out of Brushtail, an agricultural pest in New Zealand with meat high in omega-3 and -6 fatty acids. The animal is highly palatable and a quality protein alternative.

Delightibles (www.delightibles.com) offers gourmet cat treats made with wholesome ingredients and natural antioxidants. The center-filled treats are crispy on the outside and have a soft, creamy center. They are soy and wheat free.

Courtesy Delightibles

Delightibles gourmet cat treats come in chicken, turkey, tuna, salmon, beef and dairy flavors.

Caru Pet Food Company (www.carupetfood.com) offers bite-sized all-natural dog treats. The chewy, baked treats are made with antibiotic- and hormone-free meat as their first ingredient, plus blueberries and cranberries. The treats help promote strong muscles and a healthy heart, according to the company.

Courtesy Caru Pet Food Company

Caru’s all-natural dog treats are formulated without grain, wheat, gluten, corn, soy, animal byproducts or GMO ingredients.

Want information on the latest pet treat product releases?