According to the Spring 2015 Simmons National Consumer Study from Experian Marketing Services, 52% of US households (or 61.8 million) have dogs or cats, with 39% (or 47.1 million) keeping dogs and 25% (or 30.2 million) keeping cats. These data show pet ownership rates for dogs up by a percentage point (or 1.8 million households) since 2014, while ownership rates for cats were unchanged.

This contrast in ownership rate trends continues a pattern evident over the last decade. Since 2005, dog ownership rates have notched up from 34% to 39%. Combined with national population growth, that translates to a gain of 10 million dog-owning households. Over this same period, the gain in total number of cat owning-households was only 2 million, reflecting the growth in national population.

Which consumer segments account for this contrast in pet ownership rate trends? One answer is women. Cat lady stereotypes notwithstanding, pet ownership among women has veered to the dogs. That is, between 2005 and 2015, 7.7 million additional households with women became dog owners, compared with a gain of only 0.9 million households with women as cat owners. In fact, by gender of the adults in the household, the only classification to post a significant increase in cat ownership are households with men only, rising from 13% in 2005 to 18% by 2015 (see Table 1).

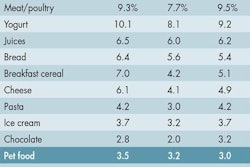

Higher-earning households are also trend-shapers.Between 2005 and 2015, 6.2 million additional households with an income of US$100,000 or more became dog owners, compared with a gain of 2.4 million of these higher-earning households as cat owners. These stats are the tip of an iceberg in pet ownership trends, in that cat ownership is sliding somewhat down the socio-economic scale (see Table 2).

Between 2005 and 2015, cat ownership rates have remained fairly steady among households with an income of under US$75,000—and even edged up, from 21% to 25%, among households with an income of US$25,000–$49,999. Among households with an income of US$75,000 or more, however, cat ownership rates dropped: from 30% to 23% among households with an income of US$75,000–$99,999, and from 31% to 27% among households with an income of US$100,000 or more. Over this period, in contrast, dog ownership notched up from 44% to 48% among these US$100,000+ households.

Given the increasing divergence whereby about half of higher-earning households keep pet dogs, but only a fourth keep pet cats, there is surely a call for pet market participants to more effectively make the case for cat ownership, and that marketing should especially send a message to women. Packaged Facts survey data for 2015 show consumers overwhelmingly agreeing that their pets are good for their physical and mental health. By gender, the distinction is that women are more likely to strongly agree, while men are more likely to somewhat agree. And by type of pet, this gender skew is stronger among cat owners than dog owners.

Among cat owners, 40% of women (compared with 25% of men) strongly agree that their cats are good for their physical health, and 52% of women (compared with 28% of men) strongly agree that their cats are good for their mental health. Those are the right kinds of numbers, and with cats themselves racking up these scores, there is no good reason for slippage in the cat lady population.