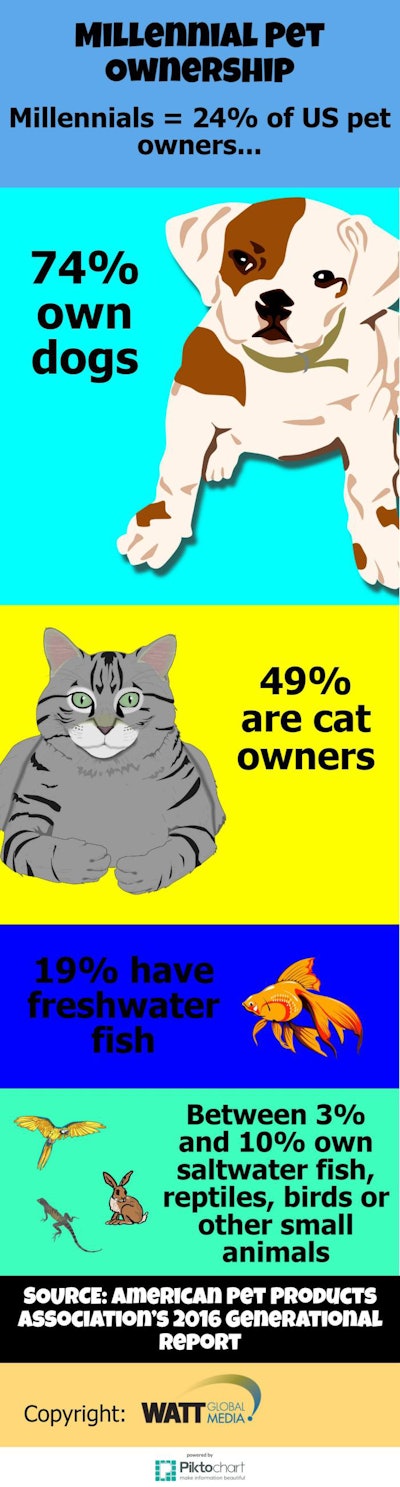

Millennials, the generation born between 1981 and 2000, make up 24% of US pet owners, according to the American Pet Products Association’s 2016 Generational Report. Of those, 74% are dog owners, while 49% keep cats. Freshwater fish make up 19% of Millennials’ pets. Saltwater fish, reptiles, birds or other small animals account for between 3% and 10% of Millennials’ menageries.

Millennials haven’t caught up to Gen X, who are 30% of the pet-owning population in the US, or the Baby Boomers (37%). However, there’s reason to believe that Millennials may become an important force in the pet food market.

As Baby Boomers age, they become less likely to own pets. American pet ownership drops off swiftly after age 60. Plus, the proportion of the population in the 40- to 50-year-old range is expected to decline. That’s a prime age group for pet ownership and spending on pets. As Millennials enter adulthood, they may fill some of this gap. Research by Packaged Facts found that millennials are much more likely than older age groups to expect to spend more for pet products and pet care services.

Millennials are also a driving force in the pet food industry trend towards premium foods. Many Millennial human food trends have even worked their way into the pet food industry. For example, organic foods and the demand for transparency in product sourcing both mirror human food trends.

Millennial pet owners are much more likely to use raw pet food or pet foods with formulations geared toward enhancing the health of their pets. Compared to pet owners in the 35+ age group, Gen Y pet owners are more likely to trust in their own ability to take care of the teeth of their pets at home and consequently are much more likely to purchase pet oral care/dental hygiene products. This is more good news for the specialty pet food market, which caters to exactly these kinds of consumer needs.