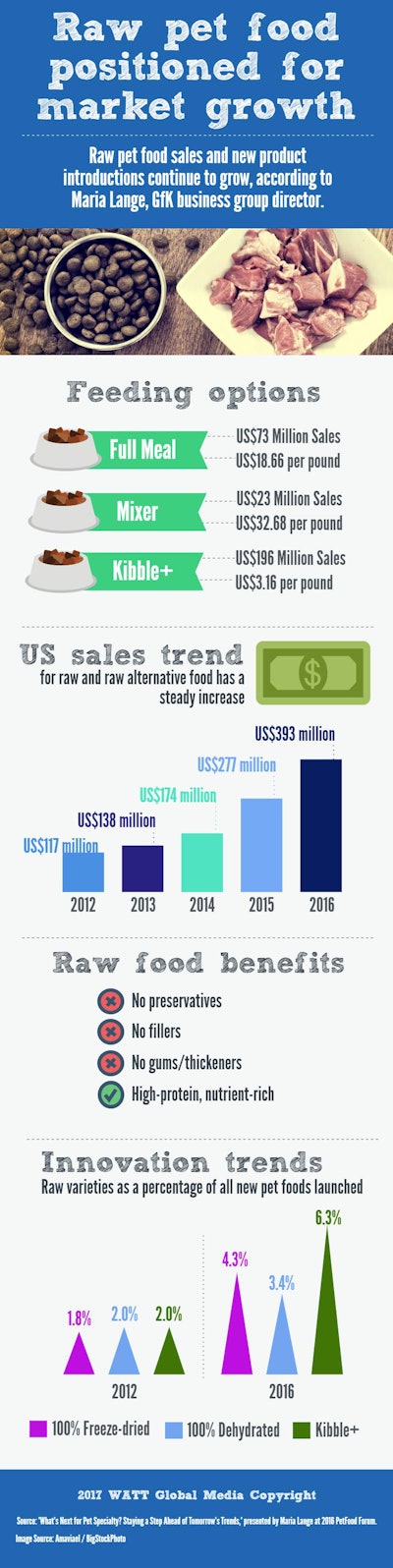

Raw pet food is positioned for market growth, thanks to consumers’ increasing demands for pet foods with no preservatives, processing or extraneous ingredients, according to Maria Lange, business group director for market research firm GfK, at Petfood Forum 2017. Raw pet food sales have already grown from US$117 million to US$393 million between 2012 and 2016 in the United States.

“It looks like a possibly perfect opportunity for the raw food industry category…if it becomes about limited ingredients and what’s not in the food,” she said. “Sales in the industry show that there is a lot of dynamic in this space, and that we might see more growth in the raw category in the years to come.”

Raw pieces of meat inherently contain no fillers, preservatives, gums, thickeners or other pet food ingredients that a growing number of customers avoid, she said. Plus, raw pet foods tend to be high in protein and nutrient rich, thus meeting the criteria of other pet food trends.

Raw pet food sales growth

Lange divided the raw pet food market into four segments. Kibble+ was defined as conventional dry dog or cat food mixed with raw ingredients, such as chunks of freeze-dried beef. Kibble+ experienced the greatest growth and highest sales in the raw pet food segment, reaching US$196 in US retail pet food sales in 2016, compared to US$49 million in 2012.

“Kibble+ is a way of bringing the raw freeze-dried or dehydrated pieces into the kibble segment,” Lange said.

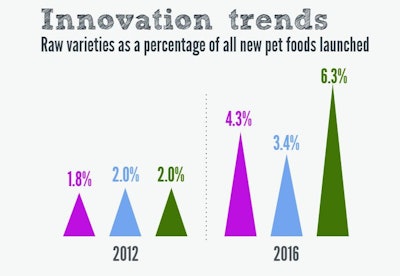

GfK counted 394 kibble+ items on the market in 2016. That number grew as kibble+ increased from 2 percent of total new US pet food launches to 6.3 percent between 2012 and 2016. Those kibble+ products sold for an average price of US$3.16 per pound.

Frozen raw pet food makes up the second largest segment with US$96 million in sales in 2016, up from US$40 million in 2012. However, frozen pet food made up only 1.4 percent of new pet foods in 2016, down from 5.5 percent in 2012.

Third, freeze-dried pet food increased in its percentage of new pet foods launched in 2016, up to 4.3 percent from 1.8 in 2012. The category also increased in retail sales from US$15 to US$67 million.

Dehydrated, the fourth category of raw pet food, didn’t increase is sales or product launches as much as kibble+ or freeze-dried, but still reached US$35 million.

“Looking at the data, you can see that even dehydrated has picked up a bit of steam over the past few years, especially 2016,” said Lange.

Full-meal versus topper raw pet food

Along with the four categories, raw pet foods can also be divided into two purposes, either as a full meal or as a topper. These full-meal raw pet foods generated US$73 million in sales in 2016 and led the number of products on the market at 424. Full-meal raw pet foods sold for an average US$18.66 per pound.

Mixers sold for yet more at US$32.68 per pound, according to GfK analysis. However, they racked up lower total US retail pet food sales, hitting US$23 million.

Raw pet food safety

Although raw pet food meets many pet food buyers’ demands, Lange warned that pet food safety can be a serious hurdle for raw pet foods.

Raw pet foods tend to be minimally processed to pasteurize the packaged foods, but not cook them. High pressure processing allows raw pet food manufacturers to do just that, although it isn’t as scientifically established as cooking to kill pathogens.

Scientists have also demonstrated that viruses, called bacteriophages or phages, can knock down Salmonella levels in raw pet food ingredients. Plus, the phages are safe for dogs and cats to eat.