The pet food market in the Middle East is expanding as countries in the region move up the development pathway, according to a new report by Market Forecast. Predicted to rise at a compound annual growth rate of 5.6% from 2014-20, the Middle East pet food market is seeing greater adoption of companion animals, a focus on higher quality products and stricter regulation for pet food safety and packaging.

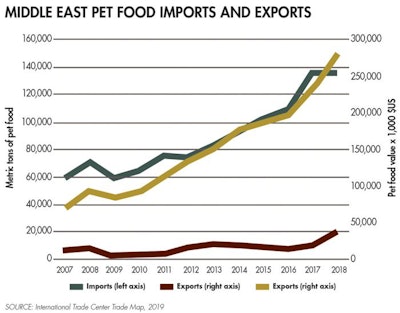

Similar trends are also apparent in the Middle East pet food imports and exports market. The region remains a net importer of pet food, with a 12-year growth rate in value of 309%, ending with US$282 million of imports in 2018. In contrast, pet food exports remain low, valued at US$21 million in 2018; 12-year growth rate in exports was also lower than imports, at 207%.

Figure 1: From 2007 to 2018, pet food imports by weight and value have increased in the Middle East, while exports have remained flat. l Source: International Trade Center Trade Map, 2019

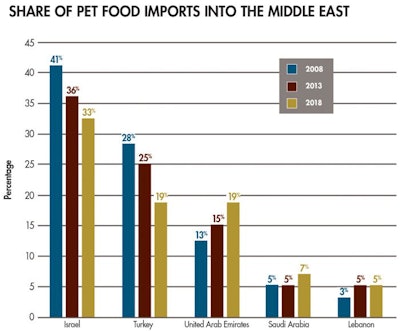

The top five pet food importers in the Middle East had an 83% market share in the region in 2018, comprising Israel, Turkey, United Arab Emirates (UAE), Saudi Arabia and Lebanon. Although that market share has decreased from 91% in 2007, higher rates of pet adoption and increasing demand for higher quality products have seen increases in pet food imports in countries like Egypt, Kuwait, Bahrain, Qatar and Jordan rise as well.

Israel, largest importer, prefers dogs; others prefer cats

Israel imported US$92 million worth of pet food in 2018, 33% of the regional market share. With its high GDP per capita (US$45,855) and small population, Israelis have approximately 450,000 dogs registered in the country, with an average age of 6 years, per a 2017 survey by the National Dog Registration Center, Ministry of Agriculture.

With each having a 19% share of pet food imports to the Middle East, Turkey and UAE strongly prefer cats as the primary pet, according to Euromonitor in a 2014 survey. The strong preference for cats was also noted in Saudi Arabia, since dogs are seen as unclean per Islamic values, the dominant religion of the Middle East, and it is advisable to keep them for hunting, guarding and shepherding purposes only.

Figure 2: A snapshot of market share of Middle Eastern economies shows the dollar value of imported pet food for 2008, 2013 and 2018. l Source: International Trade Center Trade Map, 2019

Regulations paving the way for improved pet culture in Turkey, UAE

The indicators of a growing pet industry in Turkey and the UAE are apparent in their newest regulations. In 2014, Turkey introduced an ownership certification requirement for new pet owners, part of an effort to reduce pet abandonment and ensure that companion animals’ health, shelter and food needs are well taken care of by their owners. Earlier this year, in their continuing campaign against stray and abandoned animals, Turkey has established 234 animal shelters that house more than 86,000 animals, providing financial support of US$5.8 million to 61 municipalities over nine years.

A similar regulatory and cultural shift is underway in the UAE, where new laws for animal welfare and pet food safety were introduced earlier this year. The UAE market in particular is benefiting from its status as a global hub, where luxury pet experiences are in high demand, including high-quality, fresh, human-grade organic meals provided by Furchild Pets.