As of March 1, 2022, global pet care and nutrition company Manna Pro Products is now Compana Pet Brands, and according to CEO John Howe the new corporate identity has been a long time coming.

According to the company, the Compana logo was designed as a visual representation of the Compana manifesto to “nurture what you love.” | Courtesy Compana Pet Brands

“Our company has changed dramatically in the last decade,” says Howe. “The roots of the company from a nutrition standpoint go back one hundred and fifty years, and the vast majority of that time we were in agriculture, in animal feed, that type of thing. I joined the company — it’ll be 22 years ago this summer — and that’s when we really started focusing on becoming a consumer product, very pet-focused company, and leaving those ag roots behind us. The growth has been massive. I became CEO in 2008, and our company’s revenue since then has increased eightfold through product innovation, organic growth and acquisitions. We frankly have just evolved into a very different company versus where we were then, and we felt like the time was right for a new identity to more accurately reflect what our business has become and where it’s going.”

A multi-angle expansion: portfolio growth, acquisitions, following the trends

Compana’s growth has been multifaceted, to say the least. As Manna Pro the company completed 15 acquisitions in the last 10 years, including its most recent, Oxbow Animal Health, announced on January 4, 2022. This robust activity, alongside organic growth as all segments of pet food continue to see gains, has contributed to the company’s current $600 million in revenue.

Compana’s product breadth is significant, allowing the company to expand into many segments of pet. | Courtesy Compana Pet Brands

“My view is the same humanization/premiumization trends that exist in dog and cat exist in these other segments as well,” says Howe, who says the company looks forward to the expansion into new segments of pet that acquisitions like Oxbow (a premium small animal food brand) and ZuPreem (a premium indoor bird food brand, acquired in April 2021) allow for. “The fact is, there’s reason to believe that consumables growth in these other pet categories will outstrip total pet and frankly will outstrip dog and cat, because those trends are way more nascent. I feel like we’re in a terrific position to take advantage of the changing way that consumers think about their pets through these premium brands.”

Additionally, Compana has entered the direct-to-consumer (DTC) space, acquiring Bullymake, a DTC dog subscription box, and Dinovite, an online pet brand offering premium whole food supplements and wellness products for dogs and cats.

“We want to be where the consumer is, because there are consumers who like to shop DTC, so I’m really excited about opening that waterfront up, if you will,” says Howe.

A lot of Compana’s growth is situated in the pet food trends much-familiar to the dog and cat space but also evolving in other pet segments. It’s also what Howe says sets the company apart from its competitors.

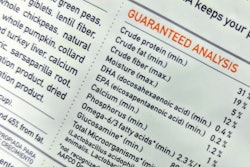

“Our view is that the same humanization and premiumization trends exist in all these categories; it’s not just dog and cat,” he says. “That’s certainly been an engine of growth for a long, long time. But our research shows that whether you own a rabbit or a guinea pig or a dog or a cockatoo they’re members of the family and they’re looking for products to help care for those members of the family and express their love through those products. Obviously the products are different, but at the end of the day consumers want for their pets what they want for themselves: simple ingredients, clean labels, ingredients they can pronounce, things like traceability, sustainability, ethical sourcing — I don’t see that playing out differently in indoor bird than it is in small animal or dog and cat.”

Compana’s biggest opportunity: continued growth

Compana has grown far beyond its agricultural roots, and Howe says he sees no reason for that to stop.

“I see tremendous opportunity for continued growth,” he says. “Continued portfolio expansion through acquisition, through innovation; continuing to increase our media spend to drive awareness of our brands; retail expansion both in the U.S. and internationally; those things are ongoing but we have a lot of white space we could go after. The pet industry is still a somewhat fragmented industry, there’s a lot of opportunity for us to continue to round out our portfolio with choiceful acquisition, and I suggest that we’re going to continue to do that.”

Staying on top of trends and meeting customers where they’re at will be key components to taking full advantage of that potential growth, says Howe.

“Humanization and premiumization are now across all pet varieties, and I see that continuing,” he says. “I think that those trends continuing will drive outsized growth in these other pet categories. It’s very, very interesting. Obviously the dog and cat category is huge, but these other pets are certainly catching up from a percent ownership standpoint.

“To me, the answer here is it starts with brands, it starts with great products — that’s the hard part,” says Howe. “The less difficult part is to be everywhere where the consumer is, whether it’s DTC, e-commerce, brick-and-mortar retail, international — that’s what we aim to do, is to have our products placed across the retail landscape, whether it’s physical or virtual, so that consumers can take advantage of them.”

Recent new products

Doggy Dailies (supplements, grooming and hygiene): bone broths; functional chews

Fruitables (dog and cat treats, toppers): Baked and Skinny Mini options

Manna Pro (feed, treats, hard goods, supplements): backyard chicken products

Natural Care (wellness, grooming): plant-based range of cleaning products