I first traveled to China and encountered its pet food market in person four years ago. In 2012, the market was brimming with potential, thanks to rapidly growing pet ownership among such a large population. Several multinational pet food companies had figured that out and established a presence in China, either via a manufacturing facility, distribution partnership or other means.

Fast forward to 2016, and not only are those and other multinational pet food players still highly active in the market; but now they have been joined by a number of domestic companies—and that number grows each year. Pet food production is booming in China and promises to stay on that upward trajectory.

Production volume reached 700,000 metric tons in 2015 and is expected to hit 1 million metric tons this year, according to Wang Jinquan, PhD, associate professor with the Feed Research Institute of the Chinese Academy of Agricultural Sciences. He presented an overview of a survey on the Chinese pet food industry, funded by the government’s Ministry of Agriculture, during Petfood Forum China 2016 on August 17 in Shanghai.

That production represented about 40% growth overall, which topped 100% in some areas of the country, Wang said. Fueling the growth are large capital investments: more than 10 new pet food factories have been built or are under construction, and Wang projected that more capital would pour into the market over the next five to 10 years as competition increases. Companies building the new plants include multinationals such as Perfect Companion from Thailand—its new factory in the Zhejiang province has an annual output of 120,000 metric tons—as well as domestic players such as Ronsy Pet Food.

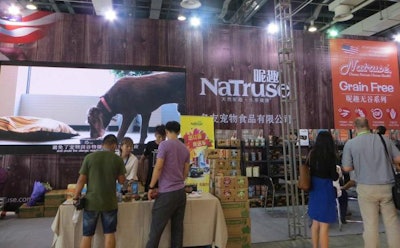

Many of these companies’ products were on display in large, elaborate (and loud!) stands at Pet Fair Asia, one of the largest pet trade shows in China and co-location partner for Petfood Forum China. The first time I visited Pet Fair Asia in 2012, it consisted of one hall, and again, most of the pet food stands represented multinational companies. Each year since then, the show has expanded significantly, reaching four halls this year and outgrowing its venue, the Shanghai World Expo Exhibition and Convention Center. (Next year both Pet Fair Asia and Petfood Forum China will move to a much larger and newer facility, the Shanghai New International Expo Centre.)

Not only are there more pet food exhibitors at Pet Fair Asia, but more of them are domestic companies, growing not only in number but also sophistication. Their packages look as sleek as those from well-established markets and boast many of the most popular claims globally, such as natural, grain free, fresh, no preservatives, as well as novel ingredients such as pumpkin, sweet potatoes and carrots. A few companies, such as Bridge Petcare Ltd., are even going multinational themselves, with Bridge establishing a European presence under the Vigor & Sage brand.

True, with the domestic companies that still sell their pet food products only in China, it’s difficult to know whether they can back up their packaging claims or if they fully understand the necessary science and processing behind them. Yet efforts are under way to address that, too: Wang also provided a progress report on new pet food regulations and standards being developed, funded by the Ministry of Agriculture as well.

The area that seems most complete to date is for registration of imported pet food products, with the new regulations intending to speed up that process. The government also seems to have established some production capacities for new feed mills and pet food plants being built. Still to come are definitions of pet food (only dry pet food has been standardized to date) as well as labeling requirements.

Growing premiumization of products, interest among pet owners

Those pet food labels are important: 17% of pet owners in China say they read ingredient labels of pet foods and treats, said Pushan Tagore, vice president of global marketing-pet care for GfK, another Petfood Forum China presenter. The percentages rise to 23% and 18% in Shanghai and Beijing, respectively; that’s right in line with the global percentage of 20.8%.

Further, GfK’s data show the average price per kilogram of pet food and treats rose to about CNY45 (US$6.77) in April 2016, a 12.5% increase since 2013, reflecting the nascent yet increasing premiumization of the market, which GfK projects to reach about US$1.77 billion by the end of this year. (The research firm tracks pet food sales in pet shops, hypermarkets and veterinary clinics, plus online, in China.) That would mean about 19% growth year over year.

Even more interesting, while the multinational brands still dominate the Chinese pet food market, its growth is being driven by local brands, Tagore said, especially in pet shops. That’s particularly true for cat food, with 81% growth for domestic brands overall and 85% in pet shops, though cat food represents just 31% of the market. With dog food, sales increases for domestic brands are more modest—about 9% overall and nearly 10% in pet shops—but the average price per kilogram of domestic dog foods brands is growing much closer to that of multinational brands.

Another sign that for the still fledgling but rising Chinese pet food market, the sky’s the limit.