The Chinese pet food market is among the fastest growing in the world, with sales increasing at least 25 percent a year and promising to continue rising at a similar pace for some time. Currently, only 2 to 4 percent of the Chinese population own pets, a share that’s likely to keep increasing as incomes also rise and more people welcome pets into their lives. And more of those people will start buying commercial pet food.

Thus, it’s no surprise that many pet food companies based outside of China see it as a very favorable expansion opportunity, particularly after witnessing the success of large, multinational pet food companies — think Mars and its divisions (Royal Canin, Iams/Eukanuba), Nestle Purina, Wellness, Total Alimentos and similar entities — in China.

Yet since those large companies established their presence in the country over a decade ago (often by forming local partnerships and businesses or divisions, then building their own manufacturing facilities there), many other pet food marketers have found it very difficult, if not downright impossible, to sell their products in China. And the Chinese government made it even more difficult at the beginning of May.

Pet food export challenges, closing a loophole into China

Many pet food companies can share stories of trying, and struggling, for years to get their products into China. At Interzoo this year, I talked with a Danish pet food manufacturer who said it took five years — and that seems brief compared with others’ experiences. Consider this tale from David Weil of Global Development and Management, a U.S.-based firm that helps pet food and pet product companies develop export markets:

“I have been working over 15 years (perhaps 20) to register a food in China. I have submitted reams of documents. I have spent days, if not months, preparing those documents. I have met with registration companies in China. I know what the formal legal requirements are. But, I don’t know what it really takes to sell directly into China (I am not talking about selling B2C through a free trade zone in China). And, I do not know of any American brands that can currently sell directly to China with a general trade license. Do you? Does anyone?”

The point of Weil’s comments, posted in April, was that, while China presents a substantial opportunity, it also presents significant challenges. Or, as he put it: “That huge China market. But, the market is not huge if you do not have access.”

The Chinese government has further restricted access by closing a loophole Weil referred to, selling to consumers (B2C) through a free trade zone. For some time, foreign companies were able to sell their products (not just pet foods) via a mechanism known as cross-border e-commerce, in which they could send the products to a free trade zone, such as Hong Kong, and an online consumer order through a Chinese e-commerce platform could be fulfilled from that inventory. But no longer: China closed the loophole, for pet food and several other product categories, as of May 1.

The change, at least as it applies to pet food, occurred because new pet food regulations took effect in China on May 1, according to Wang Jinquan, Ph.D., associate professor with the Feed Research Institute of the Chinese Academy of Agricultural Sciences and an adviser to a pet food and feed project under the Ministry of Agriculture and Rural Affairs. “Pet food from outside of China (not only the US), if it was not registered with the Ministry of Agriculture and Rural Affairs, is no longer allowed to be purchased by Chinese consumers via cross border e-commerce after May 1, 2018,” he said.

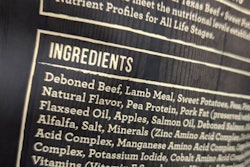

Wang did not elaborate on the new regulations yet indicated they are expansive, covering pet food labeling, packages, factories, hygienic standards, raw materials and more. “This is the first law and regulation on pet food in China,” he said. “A milestone in the development of Chinese pet food.”

(Note/disclosure: Wang will be presenting an overview of the new regulations, along with an update on the Chinese pet food industry’s production volume and status, at Petfood Forum China on August 21 in Shanghai.)

Developing domestic producers — but what do Chinese consumers want?

Wang’s comment on this milestone may point to the main reason behind the change: China is trying to help its own pet food producers develop and expand. That has already been happening; domestic producers’ share of the Chinese pet food market rose to 26 percent as of mid-year 2017, according to GfK, with the growth driven by increases in sales of premium pet foods from Chinese companies. That is projected to continue.

Yet by many accounts, Chinese pet owners still seek pet foods produced outside of China, based on brand reputation and perceived quality, nutrition and safety. That was confirmed by the recent establishment of a Canadian “pavilion” on Epet.com, one of China’s e-commerce platforms for pet products. “Epet.com is a leading company in China’s pet food industry, and the pavilion model will help meet demand from China’s increasingly brand-conscious pet owners by providing an official channel for quality, imported products,” said CEO Yu Xiao. “Through this strategy, Epet.com is creating a platform that benefits consumers and foreign brands, as well as the company itself.”

The press release stated that Epet.com also signed “strategic cooperation agreements” with several Canadian pet food brands. It’s worth noting that several — Orijen (from Champion Petfoods), Now Fresh (from Petcurean) and Nutram, for example — are already sold in China through some distribution model.

Harder road for US pet food companies

Epet.com said it views this arrangement with Canada as its new business model and is planning to launch more national “pavilions” with Australia, New Zealand and countries in Europe. It also mentioned the US, but given the current trade climate between China and the US, is that realistic?

Though many pet food companies and brands from throughout the world have struggled to get their products approved and registered for sale in China, it seems extra difficult for US companies, as Weil’s comments alluded. Entities within the US government have been working with the US pet food industry to overcome those difficulties and establish market access in China, but the trade conflict between the two countries is likely not helping that situation. At all.

Perhaps the new Chinese regulations will provide some clarity, but they may possibly make it even more difficult to export pet foods into China, forcing some companies to abandon any strategies or hopes for selling in this promising market.