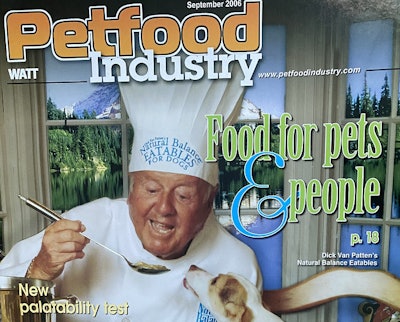

When I joined Petfood Industry magazine in 2006, the first issue I worked on featured Dick Van Patten and his Natural Balance pet food company on the cover. On December 4, 2020, we reported on PetfoodIndustry.com that the current owner of Natural Balance, J.M. Smucker, is selling the brand to Nexus Capital Management, an investment firm.

The sale is just the latest chapter in quite a saga for Natural Balance: Van Patten sold it to Del Monte in May 2013 via a merger agreement; then just six months later (October 2013), Del Monte began to essentially dissolve as a company as it sold its human food brands, then a few months later, in 2014, renamed its remaining pet food brands as Big Heart Pet Products; then Smucker bought Big Heart in 2015.

Now Natural Balance is on its own again, at least as a pet food brand; it will be Nexus Capital’s first pet product company. Its journey through the mergers and acquisition (M&A) landscape seems a fitting metaphor for how the pet food market overall has morphed and developed over the past decade, with the changes often driven by M&A.

Celebrities and investors flock to pet food

At the time we profiled Van Patten’s Natural Balance, pet food was entering a heyday of sorts, as humanization of pets took hold and market growth attracted the attention of not only pet-loving celebrities but also investors and private equity.

I should note that Natural Balance actually launched in 1989, but as the magazine article said, the company was in full-strength growth mode in 2006, led by longtime industry experts such as Joey Herrick and Frank Koch. Van Patten seemed involved at some level, matching other celebrities becoming affiliated with pet food brands: Ellen Degeneres as an owner of Halo Purely for Pets (she no longer seems involved) and Rachael Ray with her own line of pet food, Nutrish, first done in partnership with Dad’s Pet Care (ultimately renamed as Ainsworth Pet Nutrition).

Similarly, investors were flocking to pet food, drawn by heady growth rates as pet owners increasingly treated their pets as full-fledged family members and spent accordingly on them. While investment and M&A activity slowed somewhat during the Great Recession, as did pet owner spending, both picked up relatively quickly, starting in about 2010.

Since then, celebrity involvement has waned – Ray remains among the few notable exceptions – yet investor participation continues unabated to this day.

Human food, grocery brand conglomerates enter

Del Monte’s acquisition of Natural Balance in 2013 seemed to signal a coming big wave of the human food giants moving into the premium pet food space, presaging big deals like General Mills buying Blue Buffalo in 2018. Though Del Monte did already own pet food brands traditionally sold in mass market outlets like grocery stores, such as Meow Mix, 9 Lives, Milk-Bone and Pup-peroni, it entered a new level with Natural Balance.

Del Monte seemed focused on building on Natural Balance’s superpremium status, plus the sheer volume of the other pet food brands, when it divested its iconic human food business, then renamed itself as Big Heart Pet Products. Curiously, that focus lasted only four months, until Smucker’s purchase of it in February 2015. The deal interestingly took the legacy Del Monte pet food brands back to their human food roots, at least in terms of their parent company.

When Smucker subsequently purchased Ainsworth, including the Nutrish line, in 2018, it seemed to make Natural Balance the odd brand out as the main, purely superpremium one. Another interesting twist: Ray’s brand had originally been considered superpremium, but it had successfully entered into the mass market world back in 2008, figuring out how to offer premium features and ingredient claims at price points that would work in the grocery aisle. This may have been the beginning of the “mass premiumization” trend that is fairly common today.

Now, Smucker’s sale of Natural Balance is a sign that the company sees its future with not only Nutrish but also all those original Del Monte mass market pet food brands. “Today’s announcement helps the company further focus on the core brands within our pet food and pet snacks portfolio including Rachael Ray Nutrish, Milk-Bone and Meow Mix among others, which together create a unique portfolio with significant long-term growth potential that meets consumer needs across value, mainstream and premium offerings,” said Mark Smucker, president and CEO of J.M. Smucker, when the divestiture news was released.

Does this signal move away from premium, pet specialty?

By “premium,” I assume Smucker was referring to the Nutrish line. Regardless, it’s clear Natural Balance, a superpremium brand traditionally available in channels like pet specialty, no longer fits the Smucker strategy. What we can’t foretell is whether this portends a move away from superpremium, and the specialty channel, for the market overall or just for this one company and situation.

Yes, premium and superpremium have driven pet food growth for some time now; but the economic toll of the COVID-19 crisis on many pet owners may spur them to trade down to lower-priced pet foods, as happened to some extent during the Great Recession. Will Nexus Capital have better success with Natural Balance, as General Mills has had with its premium-level acquisition, Blue Buffalo? Remember, the latter has moved full force into the mass market channel now, too.