BRF, one of the world’s largest producers of poultry, along with compound feed and other foods, has made a significant foray—and splash—into the global pet food market by acquiring not one, but two pet food companies in Brazil in less than two weeks.

With the first acquisition, of Hercosul, announced June 18, 2021, BRF executives claimed their intent was to become one of the “largest and most relevant players in the Brazilian pet food market by 2025.” The company’s security filings also said that the acquisition would immediately give it an estimated 4% of the Brazilian pet food market, based on data from Abinpet (the Brazilian pet trade association).

Proving that intention, BRF announced only a week later, on June 25, that it was also acquiring Mogiana Alimentos, another Brazilian pet food producer. (Actually, BRF is buying Paraguassu Participações and Affinity Petcare Brasil Participações, holders of 100% of the capital stock of Mogiana Alimentos.)

With these purchases, BRF now has a pet division and will own about a 10% share of the market, thus helping to achieve its stated goal of becoming a pet food leader in Brazil.

Attracted by growing Brazilian pet food market

In an interview with Reuters, Lorival Lutz, CEO of BRF, said he doesn’t foresee any more pet food-related deals on the near horizon. But in its filings, the company did indicate it was attracted to Brazil’s pet food market because it is growing—and Lutz seems to intend to contribute to that rise by growing both his new companies organically.

Company executives also cited a desire to diversity revenue streams as a reason for the acquisitions, which makes some sense with the pandemic-driven supply chain disruptions, and accompanying rising costs, in the human food industry, particularly the meat sector. (Though the pet food industry certainly hasn’t been spared, suffering many of the same problems.)

And BRF is correct about the Brazil pet food market’s growth. It has been rising for more than a decade now, at one point surpassing Japan as the second largest market after the U.S. Though the pandemic hit some economies and households hard, especially in developing markets, Brazil followed the pattern shown in many other countries, according to Euromonitor: Pet ownership increased by nearly 20% among more affluent Brazilian households (with income exceeding US$150,000) in 2020. So perhaps BRF will eventually go on another pet food acquisition spree in coming years.

Vertical integration combined with pet humanization

According to WattPoultry.com’s World’s Top Companies, which lists the leading broiler, turkey and egg producers globally, BRF ranks second behind only JBS, another Brazilian conglomerate. Coming in at number 3 is Tyson. Interestingly, that company just divested its pet treats division in May 2021, selling it to General Mills. Though Tyson executives said the business was successful, they had decided to focus on the company’s core business.

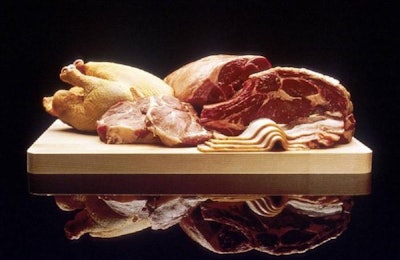

It’s likely that when Tyson created its treats division, it saw a natural integration of its vertical supply chain and capabilities, drawing on its poultry business as the main protein source for the pet treats. And BRF probably sees the same opportunity with not only its high level of poultry production (including turkeys) but also its compound feed business, considering the overlap and intersections between feed and pet food production.

Still, these two leading poultry players have now chosen opposite directions in their involvement in pet food, at about the same time, which speaks to the current dynamic nature of the market and the economy overall. While pet food is emerging from the pandemic with record growth, and projections point to that growth continuing, many things are still in flux. The one thing we can probably be certain about is that the pet food market will continue to attract interest, investors and new owners from the human food industry, thanks to the now-ingrained humanization of pets.