Economic sluggishness notwithstanding, petfood remains private label resistant in the US mass channels tracked by SymphonyIRI (supermarkets, drugstores and mass merchandisers excluding Walmart). During 2011, total US sales of petfood rose 1.8%, while private-label sales of petfood fell 4.4%. As a result, private label share of total petfood sales slipped from 9.6% to 9.0%.

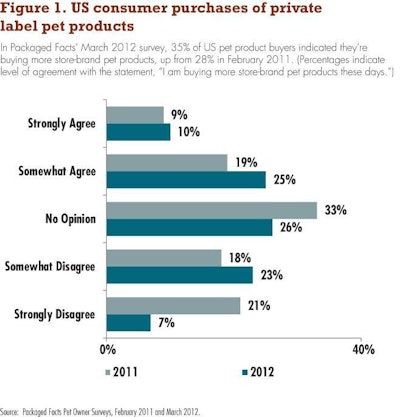

But petfood marketers would be well advised not to ignore the inroads being made by private label. In Packaged Facts’ March 2012 survey, 35% of US pet product buyers indicate they’re buying more store-brand pet products these days, up from 28% in February 2011 (Figure 1). And plenty of action in petfood private label is taking place outside the mass channels tracked by SymphonyIRI, at the upper and value ends of the pricing spectrum alike.

Whole Foods: According to Whole Foods’ 2010 annual report, sales of store brand products across all categories amounted to approximately 11% of the chain’s overall retail sales in fiscal years 2010 and 2009. However, the retailer allots a somewhat higher proportion of its pet department shelf space to private label—about 15%, Packaged Facts estimates.

The upscale chain’s pet department emphasis on private label is apparent in its strategic placement of its store brands. In petfood and treats, the bright green 365 and Whole Paws packages are centered among manufacturer brands, making the store brands virtually impossible to miss. This placement also allows for easy price comparison, with the store brands offering significant price advantages. For example, whereas 5.5-oz. cans of wet cat food are priced around US$1.50 for Wellness or Organix, the same size can of 365 wet cat food is 59 cents.

PetSmart: Like Petco, PetSmart continues its quest to trade consumers up to higher-margin superpremium foods, with a strong focus on natural, and the strategy does not exclude private label. To “complement” national brands including Wellness (WellPet) and Innova (Natura), PetSmart recently introduced its own Simply Nourish. The superpremium natural petfood for dogs and cats hits all the major holistic marks, including no fillers, real meats, carefully sourced (read: safe) ingredients and limited ingredients. In its October 2011 analyst day presentation, PetSmart indicated natural/superpremium foods deliver double the margins of regular grocery brands like Pedigree and significantly higher margins than pet specialty/mass bridge brands like Iams.

Sam’s Club: Compared with the typical supermarket or Walmart, the pet product selection in wholesale club stores is extremely limited, making it all the more significant that Sam’s is fielding a new private label, the Simply Right petfood line, and heavily featuring it department-wide. Launched in 2011, the store brand includes Complete Nutrition dog food and cat food, Exceed dog food in Chicken & Rice and Lamb & Rice formulas, Crunchy Bites & Savory Cones dog food for all breeds, High Performance dog food with higher protein and fat to support active dogs and Simply Right Del Monte wet dog food.

Walgreens: All the US national drug chains—Walgreens, CVS and Rite-Aid—have been beefing up their pet departments in recent years. In Walgreens, approximately three-quarters of the space goes to petfood and treats, with the store’s own brand heavily featured. The Pet Shoppe private label is represented across most categories, in several cases constituting the only choice. In petfood, Pet Shoppe goes head to head with national brands including Iams and Purina One, with the dry cat food line including indoor and gourmet formulas and the dog food edibles including Crunchy Bites complete diets and premium jerky strip treats.

Dollar General: One of the most striking features of Dollar General’s growing pet department is its ubiquitous emphasis on private label. The chain’s EverPet line is present in virtually all categories, usually side by side with the national brand counterpart. In several nonfood categories, EverPet is the only choice, including for pet beds, litter boxes and toys, and the store brand also carries its own weight in pet treats and rawhides. In the pet treats category, the product packaging designs vary to line up with the national brand counterpart—for example, EverPet Wavy Bacon treats face off against Purina’s Beggin’ Strips.