As in the human consumer products market, customization and personalization are key strategies for differentiation, premiumization and locking down customer loyalty.

Customization as a competitive strategy

Per Packaged Facts’ January 2022 Survey of Pet Owners, customized pet food diets attract 12% of dog owners and 11% of cat owners, providing a competitive strategy for direct-to-consumer (DTC) marketers of fresh pet food such as The Farmer’s Dog or of customized kibble such as Muenster Milling. Similarly, looking at the pet product marketing landscape beyond pet food, subscription programs such as BarkBox inherently involve customization and personalization per the shopper’s individual demands, as do compounded medications as available through Chewy Pharmacy, or Petco’s dog grooming options.

Again in tandem with the human market, “microbiome” is becoming a pet market buzzword, joining other “gut health” terms including probiotics and prebiotics. The movement encompasses the pet nutrition gamut: pet food, pet treats and pet supplements. This trend has been spurred by the pandemic-related increased demand for products targeting immunity, as is also true in the CBD-fueled pet stress and anxiety arena.

Pet food makers have long incorporated probiotic nutraceuticals into their product lines, with Hill’s devoting a website page to the topic of microbiome and its new ActivBiome+ Technology (“a breakthrough prebiotic blend that revolutionizes how you care for your pet’s digestive health and well-being”) and Nestlé Purina fielding gut health supplements such as Nestlé Purina’s Pro Plan Veterinary Supplements Calming Care Probiotic. In July 2021, Cargill invested in pet industry startup AnimalBiome, whose products and services are rooted in the science of the microbiome “to assess, restore and maintain gut health of cats and dogs.” Given the direct crossover into human health trends and concerns, Packaged Facts expects microbiome-based products to be in high demand among health-focused pet owners in the years ahead.

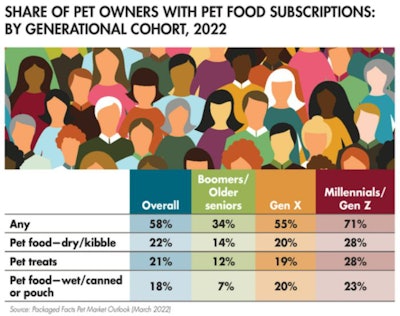

Customization also ties in to autoship and DTC marketing. Packaged Facts’ January 2022 Survey of Pet Owners shows 22% of pet owners having autoship subscriptions for kibble, rising to 28% when you look at the millennials/Gen Z demographics (see Table 1).

Microbiome science figures into Mars Petcare’s recently acquired DTC fresh pet food unit NomNomNow, which in addition to food and treats offers probiotic supplements for dogs and cats as well as a microbiome testing kit.

DTC loyalty options

Autoship, in bypassing traditional retailing and merchandising, inherently paves the way for DTC sales. For the past few years, most of the DTC attention in the pet market has gone to fresh pet food, where companies like The Farmer’s Dog have been taking on kibble and canned pet foods with heavy marketing including an onslaught of television commercials. Nonetheless, Mars Petcare’s acquisition of Pretty Litter cat litter in September 2021 signals that DTC will be a force beyond pet food in the years ahead and indicates the direction where pet product shoppers are headed.

Although customization and personalization are usually the handmaidens of premiumization, customization can also be leveraged to help make pet parenting expenses more targeted and therefore affordable. Mita Malhotra, vice president of Chewy Health, noted, “The launch of customized care plans specifically designed for our customers is an important enhancement to the Chewy Health ecosystem, advancing our mission to make pet healthcare more affordable and accessible for all pet parents” (Chewy press release, December 7, 2021).

Pet food M&A off to fast start in 2022