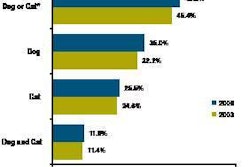

This year is starting off on a sour note, as the recession takes its toll around the world. Every day brings new headlines about companies cutting jobs or more people losing their homes. What does this mean for petfood? While finding up-to-the-minute data is difficult, one source shows that at least in the US, dog and cat food sales are still growing.

According to Information Resources Inc.'s Infoscan Reviews, US dog food sales increased 11.6% overall in the six months ending November 30, 2008 (Table 1). US cat food enjoyed a 12.3% gain overall in the same period.

Not all product segments grew at the same rate, and some not at all. With dog food, for example, dry grew at a robust 15.2%. But wet increased only 2.4%.

Nearly every segment within cat food increased in sales, with dry the biggest winner (16.2%). Wet also saw a gain, at 8.7%, and the raw/frozen segment grew more than 2,000% (though at very small numbers).

As you look at changes in volume, you could conclude that much of the sales gains probably came from price increases and sales of higher-priced products. The growth in dog food volume for the same six months was only 4.5%, less than half of the sales increase. For cat food, volume growth at 9.2% was closer to the sales growth percentage.

What's most encouraging is that the month-to-month data between June and November 2008 show that growth held steady or became even stronger toward the end of the year, at the same time the US economy was getting much worse.

We can't ignore that millions of consumers globally are suffering; and we're hearing more reports of pets being turned in at US animal shelters. The good news is that most pet owners are still feeding their dogs and cats well.

.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)