In the January 2015 edition of Petfood Industry magazine, we asked some of the pet food industry’s top experts to predict the state of the industry throughout 2015. Now, a little more than halfway through the year, we’ll take a second look at those predictions and how they’ve played out so far—as well as what’s in store for the rest of 2015.

Premium pet food was a hot topic going in to 2015, as experts predicted that this segment of the industry in particular would be the one to watch for growth. So far, they seem to have hit the mark: superfoods are gaining ground as viable ingredients to provide any number of purported health and nutrition benefits, and subcategories such as fresh/frozen/raw and freeze-dried are making the rounds as customers look for the very best for their pets.

Ingredients such as kale, blueberries, sweet potatoes, pomegranates, pumpkin, and various seeds and powders are making their way through pet food formulas, showing up so far in 2015 products as varied as energy and protein bars, jerky treats and full cooked entrées. Formulas that claim allergen friendliness, limited ingredient lists and all-around pet health are particularly likely to include such “superfoods.”

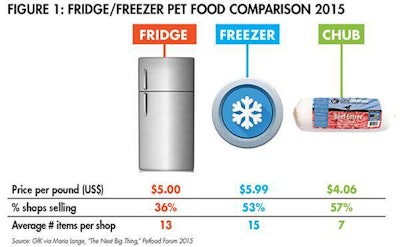

According to GfK’s Maria Lange, refrigerated and frozen pet foods are seeing significant opportunities on store shelves. In her Petfood Forum 2015 presentation, “The next big thing: Based on sales trends in pet retail specialty,” she highlighted the potential of such products. As of March 2015, 36% of shops selling pet food included refrigerated foods on their shelves, while 53% of them carried frozen pet food options (see Figure 1). Fifty-seven percent of those stores carried chub-packaged products in particular. And the options are there, as well, considering these categories’ more niche status in the specialty category: the average number of refrigerated pet food options per shop that carries them is 13, while an average of 15 frozen food options can be found. Seven different chub-packaged products on average can be seen on store shelves that carry these types of products.

The potential for refrigerated and frozen pet food in stores selling pet foods is significant. The price per pound among these food types is fairly steady (between roughly US$4.00 and US$6.00 per pound) and more than half of pet food stores carry frozen products already. The variety of these products is relatively small, leaving plenty of room for market growth on the shelves.

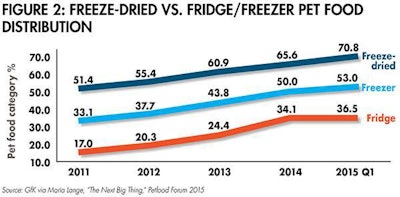

While refrigerated and frozen pet foods continue to enjoy double-digit growth, they sometimes lack distribution options due to the very niche status that makes them desirable to superpremium pet food shoppers. However, freeze-dried pet food is gaining ground in terms of both distribution and overall accessibility as manufacturers find ways to bring the price points of such products down. As of March 2015, according to Lange, nearly 71% of stores sold freeze-dried products (see Figure 2)—a trend that’s expected to carry through the rest of the year and into 2016. Companies are taking advantage of this, using freeze-dried pet food products as potential gateways into raw pet food, touting the convenience factor and aiming to bring more customers in with yet another healthy food option for their pets.

The percentage of stores selling freeze-dried pet products continues to steadily grow above and beyond frozen and refrigerated products, though all three categories have been experiencing growth in the last several years. As of March 2015, nearly 71% of stores sold freeze-dried pet food products.

Pet treats continue to be a significant growth opportunity, as the industry predicted at the beginning of the year and Packaged Facts’ David Sprinkle confirmed at Petfood Forum 2015. While treats haven’t gained the market share that cat or dog food can claim, the variety of treat options and overall increased spending of pet owners on products for their animals bodes well for the segment. The types of treats being purchased in 2015 range from jerky to chews to functional treats and beyond. According to Packaged Facts, 12% of cat owners and 27% of dog owners have purchased pet jerky this year, and 8% percent of cat owners and 31% of dog owners gravitate towards rawhide/natural chews. Thirteen percent of cat owners and 36% of dog owners purchase dental chews for their pets, and 56% of cat owners and 77% of dog owners have purchased some other type of treat in 2015.

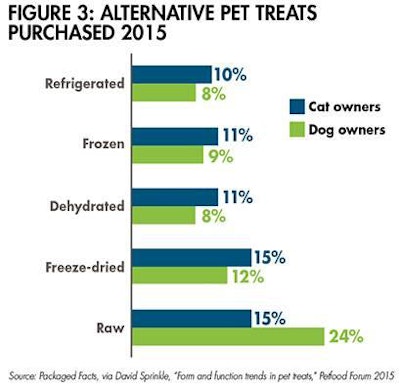

Treats are also providing another opportunity for manufacturers to gain a foothold in the specialty market. According to Packaged Facts data, 42% of dog owners and 39% of cat owners have purchased an “alternative format” of pet treat: refrigerated, frozen, dehydrated, freeze-dried or raw (see Figure 3). Dog owners who purchase such treats lean significantly towards raw options, while cats are more evenly spread out among all the categories.

Alternative forms of pet treats, such as those riding the trends of refrigerated, frozen, freeze-dried and raw pet foods, are seeing some growth, though they remain a niche subset of the overall pet treat market.

While more mature global pet food markets are experiencing the growth predicted by industry experts at the beginning of the year—that is, with the exception of certain specialty segments, not much growth at all—developed markets are experiencing a mix of growth and challenges. Russia, for instance, is looking at a potential drop in pet food sales volume due in part to the fall of the exchange rate of the Russian ruble against the US dollar and Euro at the end of 2014. The size of the market might hit its lowest numbers in a decade, according to analysts. Manufacturers in the market are responding by increasing sales prices 30–40%, something retail stores in the country are trying (not altogether successfully) to mitigate. It looks to be a difficult remainder of the year for Russia’s pet food market.

Asia is a mix of mature markets seeing negligible growth (Japan) and developing markets recovering from several years of market fluctuations (China). China’s pet food market has been up and down since 2005, but is now projected to continue growing through 2019—significant for a country that has been beset for several years by various domestic pet food safety and global market woes. Southeast Asia (SEA) also has significant growth to look forward to, according to a recent report by Future Market Insights. “Pet Care Market: Southeast Asia Industry Analysis and Opportunity Assessment 2014–2020” says that SEA growth will hit 6.8% by 2020. In particular, the pet care market in the Philippines is expected to register a significant compound annual growth rate (CAGR) of 8.4% through 2020. This is expected to be followed by Vietnam, with a CAGR of 8% during the forecast period, according to experts.

Poland is an example of a developing market seeing solid growth. The country’s pet food market posted an increase of 9% in 2014, with sales expected to expand by a further 5% to a total of PLN2.3 billion (US$639 million) in 2015, according to figures released by market research firm Euromonitor International. With such growth, the domestic market is looking to expand its production and its options as producers aim to take advantage of the stability.

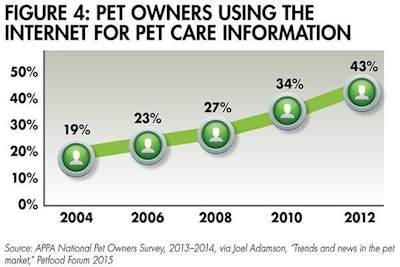

The Internet, as predicted by experts at the beginning of the year, continues to be a purchase point to watch. According to Joel Adamson with Brakke Consulting Inc. (during his Petfood Forum 2015 presentation, “Trends and news in the pet market: Important considerations for business planning”), the fastest-growing market channel is online. The use of mobile devices for information and online shopping is growing rapidly, and something all pet food manufacturers and retailers should be considering is the versatility of their websites: are they mobile-friendly? Intuitive? Do companies have social media plans in place to take advantage of the increasing number of ways to communicate with their customers? According to an APPA national pet owners survey in 2013–2014, in 2012 43% of pet owners were using the Internet for pet care information (see Figure 4). This number, according to Adamson, is only expected to increase.

As the Internet grows to become one of the top purchasing outlets for consumers, pet food producers must be aware of how consumers are informing themselves on pet products—and how they’re buying them.

Unsurprisingly, pet food industry experts were largely on point with their predictions at the beginning of the year. As business strategies for 2015 are now in full swing and companies begin looking to 2016 options, it’s clear that consumers’ needs will continue to be met as manufacturers stay on top of the trends.

In-depth trends analysis

Specialty pet food: www.petfoodindustry.com/articles/5080

Superfoods: www.petfoodindustry.com/articles/4941

Freeze-dried pet food: www.petfoodindustry.com/articles/5233

Pet treats: www.petfoodindustry.com/articles/5232