Specialty pet foods and treats continue to outperform other segments of the pet food industry, leading to significant market growth and opportunities for manufacturers looking to expand. While “specialty” covers a lot of ground when it comes to product categories, there are two things the majority of pet foods have in common under this umbrella: most specialty products can also be classified as “premium” or “superpremium,” and many of them fall under the “natural” or “organic” headings.

All of these potential groupings bode well for companies looking to enter, maintain or expand their place in the specialty market. Pet specialty retail sales of pet food hit US$11.8 billion in the US in 2013, according to Packaged Facts. Premium pet food sales accounted for 42% of total US pet food sales in 2014. And, according to Packaged Facts’ September 2014 report, Natural, Organic and Eco-friendly Pet Products in the US, 5th Edition, sales of natural pet food through all channels came in at US$7.3 billion in 2014, up from US$4.2 billion in 2010.

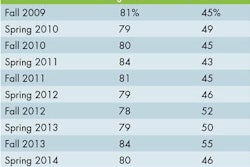

What’s more, according to the report, while natural pet food has felt the impact of the recession over the past few years, it has since rebounded significantly. Looking ahead, the sales growth of natural pet food is expected to significantly outpace that of pet food overall during the next five years, with a CAGR (compound annual growth rate) of 14.6% for the 2014–2019 period, similar to that of the 2010–2014 period (see Figure 1).

The sales growth of natural pet food is expected to significantly outpace that of pet food overall during the next five years.

“Natural remains pretty much the only game in town when it comes to high-growth dog and cat food items,” said Maria Lange, senior product manager of GfK’s Retail and Technology team, in November 2014. “Dog and cat owners have shown a willingness to pay extra for emerging benefits—such as gluten-free and freeze-dried—that often mimic the ones seen in human food. Manufacturers and retailers need to give their customers access to the latest talked-about SKUs while keeping actual sales dollars in perspective; categories posting the highest growth and capturing the most headlines may still be minor forces when it comes to meeting revenue targets.” At a Global Pet Expo 2015 seminar, Lange said that natural pet food and treat sales have increased 7.4% since 2013 and accounted for eight of 10 new pet food items in 2014.

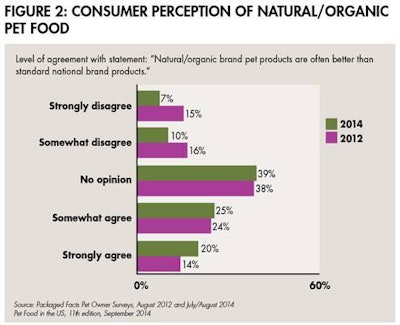

The premiumization trend continues to be a significant driver towards increased sales of natural and organic products, according to Packaged Facts in Pet Food in the US, 11th Edition (September 2014). “Although not all superpremium products are natural, more and more of them most certainly are, with natural products at the core of the premiumization trend, especially on the pet food side,” says the report. In addition, many of these products are focused on pet health—a plus for natural and organic products, since many consumers view them as being inherently better for their pets (see Figure 2).

Many consumers view natural and organic products as being inherently better for their pets, a boon for an ever-growing segment of the pet food industry.

Pet specialty stores and smaller, independent pet stores are the primary benefactors of natural and organic pet food sales; in fact, natural and organic pet foods are key for these channels. Petco has a special department for such products, It’s All Natural, and PetSmart is using branding to market itself as “the most trusted source for natural pet solutions.” Both chains feature a wide variety of natural and organic brands.

In a 2014 Pet Business readership survey, 40% of respondents said they identify their business as a “natural” pet food store. Nearly two-thirds of respondents said their pet food selection is more than 75% natural and/or organic, and another 27% said natural and/or organic pet food make up 51–75% of their pet food offerings.

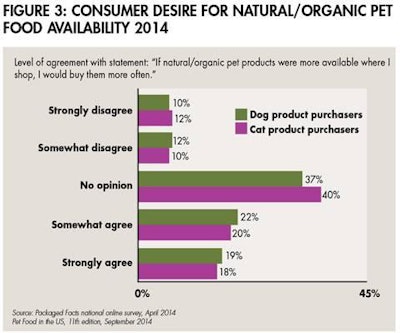

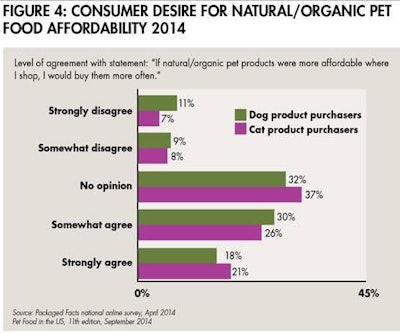

Location and price of these natural and organic products can go a long way for consumers: in a Packaged Facts April 2014 Pet Owner Survey, 41% of dog product purchasers and 38% of cat product purchasers agreed with the statement, “If natural/organic products were more available where I shop, I would buy them more often.” (See Figure 3.) In the same survey, 47% of dog product purchasers and 48% of cat product purchasers agreed with the statement, “If natural/organic products were more affordable where I shop, I would buy them more often.” (See Figure 4.)

Forty-one percent of dog product purchasers and 38% of cat product purchasers agreed that if natural and organic products were more available where they shop, they would buy them more often.

Forty-seven percent of dog product purchasers and 48% of cat product purchasers agreed that if natural and organic products were more affordable where they shop, they would buy them more often.

In 2014, 38% of dog product sales and 40% of cat product sales came from natural products, according to a State of the Industry survey conducted by Pet Product News International. Given all the solid numbers coming through for natural and organic pet products, how are manufacturers responding? They’re putting out more innovative, specialty, premium pet foods and treats that meet the needs of consumers looking to provide healthy, natural and organic meals for their pets:

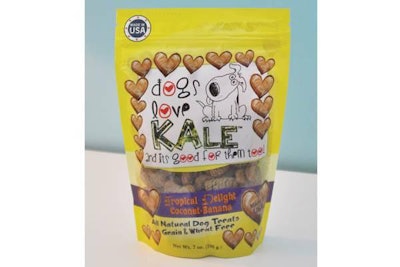

Dogs Love Kale (www.dogslovekale.com), a division of Twiggy’s Cupcake Diet Inc., has launched two new flavors in their line of grain-free and wheat-free treats: Sweet Tater’ and Tropical Delight (coconut and banana). These all-natural treats are 100% sourced and made in the US, according to the company. Dogs Love Kale treats have rice flour, kale, whole oats and flaxseed as their main ingredients, adding either peanut butter, pumpkin or apple to create various flavors. No animal ingredients are included in the products.

Courtesy Dogs Love Kale

Dogs Love Kale’s Tropical Delight dog treats are all-natural, grain-free and contain no animal ingredients.

Hi-Tek Rations (www.hitekrations.com) has introduced Hi-Tek Naturals Just for Puppies, an all-natural pet food with no artificial flavors or preservatives. The product features protein from chicken meal; whole grains from brown rice; vitamins and minerals; antioxidants from cranberries, blueberries, spinach and flaxseed; and pre- and probiotics. The new formula has been developed for puppies that have just been weaned until 12–18 months of age.

Courtesy Hi-Tek Rations

Hi-Tek Rations offers Naturals Just for Puppies, an all-natural pet food designed for puppies that have just been weaned until 12–18 months of age.

Merrick Pet Care (www.merrickpetcare.com) has introduced Merrick Backcountry, an all-natural, grain-free, high-protein ancestral canine diet. The Game Bird Recipe, for example, is made with turkey, duck and quail, plus a chicken freeze-dried raw inclusion. The entire formula is 38% protein. The Backcountry line has both dry and canned recipes for dogs.

Courtesy Merrick Pet Care

Merrick Pet Care’s Merrick Backcountry is an all-natural, grain-free, high-protein ancestral canine diet.

Purina Beyond (www.beyondpetfood.com) is a new line of natural dog and cat foods that uses real, natural ingredients, plus essential nutrients. Recipes include real meat, poultry or fish as the number one ingredient; no corn, what or soy; no poultry by-product meal; and no added artificial colors, flavors or preservatives. The Herring, Egg & Sweet Potato recipe, for example, contains those items (superfoods known to be nutrient-dense, according to the company) as the key ingredients.

Courtesy Purina

Purina Beyond, a natural line of cat and dog foods highlighting natural ingredients and essential nutrients. The Herring, Egg & Sweet Potato cat food recipe, for example, contains those items (superfoods known to be nutrient-dense, according to the company) as the key ingredients.

Natural Balance Pet Foods (www.naturalbalanceinc.com) has announced its new, grain-free recipe made with minimally processed, freeze-dried raw pieces of high protein mixed with kibble. Wild Pursuit wet and dry formulas for dogs and cats, plus treats for dogs, contain unique protein sources such as guinea fowl, quail and walleye. Other ingredients include those promoting healthy skin and coat, and fruits and vegetables contributing fiber to support healthy digestion.

Courtesy Natural Balance Pet Foods

Natural Balance Pet Foods offers its new, grain-free recipe made with minimally processed, freeze-dried raw pieces of high protein mixed with kibble. The Wild Pursuit line has wet and dry formulas for both cats and dogs.

PetfoodIndustry.com’s pet product database

www.petfoodindustry.com/directories/114-pet-food-product-database