In relation to cat product shopping, supermarkets show distinctive patterns and demographics.

Cat products: by the numbers

To look at the dollars first, supermarkets account for 47 percent of wet/canned cat food sales through mass-market retailers (excluding the pet specialty channel), compared with 40 percent of wet/canned dog food sales, according to Nielsen data. Similarly, supermarkets account for 35 percent of dry cat food sales in the mass market, compared with 30 percent of dry dog food sales.

Moreover, according to Simmons Research data, those who own cats but not dogs are dramatically more likely to purchase pet products at least in part through supermarkets (53 percent), compared with those who own dogs but not cats (29 percent). Of the three main retail channels for pet products — pet superstores, discount stores and supermarkets, in that order — patterns diverge this extremely by cat versus dog ownership only in the special case of supermarkets.

Demographics of supermarket shoppers

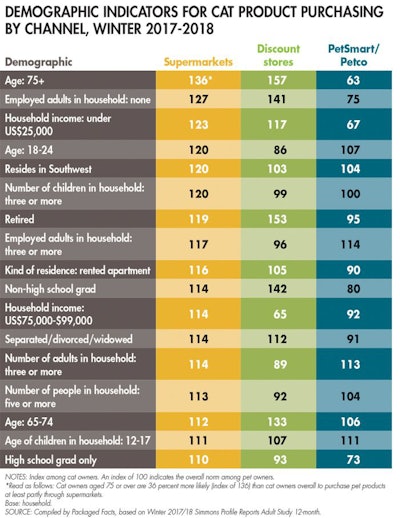

In this relationship to overall pet ownership patterns, the exceptionalism of supermarkets within the cat category rests on the bedrock of the pet industry. Demographic factors also kick in here, in keeping with the higher costs associated with dog ownership (see Table 1). Supermarket shoppers for pet products are generally on the opposite end of the socioeconomic seesaw, compared with the pet superstore crowd.

- Supermarket customers for pet products are 36 percent more likely than average (an index of 136) to be age 75 or over, while pet superstore customers are 37 percent less likely to be senior citizens (index of 63).

- Supermarket customers for pet products are 23 percent more likely than average to have a household income under US$25,000 (even more so than discount store shoppers, at 17 percent), while pet superstore customers are 33 percent less likely than average to be in this lowest economic bracket.

Even so, there is considerable diversity in the supermarket shopper for pet products. While senior citizens are prime customers, so are 18- to 24-year-old cat owners (at an index of 120), given that either end of the adult age bracket ladder falls outside of what are typically the highest income-earning years. While cat-owning households with no employed adults are prime customers, so are households with three or more adults (at an index of 117), here again attributable to economic factors, given the need for shared housing among lower-income adults. And being retired or having three or more children in the household both qualify as indicators for buying cat products in supermarkets, again attributable to budget factors, because households with several children have ample parenting expenses in addition to the pet ones.

A unique opportunity for supermarkets

Given the market need for quality but affordable pet care products, supermarkets have a unique opportunity that goes back to the bedrock of overall pet ownership patterns. The number of cat-owning households who buy pet products at supermarkets (15.9 million) is much higher than that for discount stores (7.7 million), as their main value-shopping rivals. To double down, the same holds true for owners of both cats and dogs, with 7.4 million such households shopping in the pet aisles at supermarkets, compared with 3.7 million at discount stores.

More information on Packaged Facts’ pet market coverage