The pet treats and chews market closely follows the major trends in pet food overall, given that many of the same marketers, brands and product benefits are at play. U.S.-sourced, natural/organic and functional products are the most sought-after types of treats, along with limited/single ingredient, raw, exotic protein and locally sourced offerings. Indulgent items, especially products that mimic the flavor profiles of favorite human foods, also remain in strong demand, as do dental chews and treats that simultaneously serve functional, pampering and pet entertainment/stimulation needs.

All these trends tie more broadly to the pet humanization trend, whereby owners see pets as highly valued household members and personal companions, and correspondingly are highly receptive to products similar in quality and appeal to the ones they buy for themselves. In the treats market humanization plays out in many ways, including through ingredient trends, product appearance and the growing “clean label” or transparency trend in sourcing, labor practices, manufacturing and ingredients that is reshaping the packaged foods industry overall.

Top claims in the pet treats category

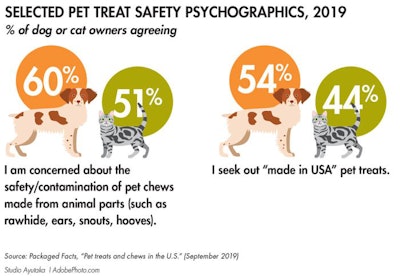

Packaged Facts survey results show about half of dog or cat owners seek out pet treats “made in the USA,” making this the most significant product formulation claim in the category. As is the case in the pet food market, made in the USA is strongly associated with product safety concerns, dating back to the pet food recalls of 2007 stemming from Chinese-sourced vegetable proteins adulterated with melamine.

Although the term remains highly subjective in any market, “natural” products, for which the use of natural rather than artificial ingredients is central to product positioning, also make up a large part of the pet market, including in the treats category. Natural as well as certified organic treats are no longer a niche — most major marketers currently field at least one brand line devoted entirely to natural or organic products, and many retailers have launched natural or organic private-label lines. At the same time, in the wake of rawhide pet treat recalls in the last few years, pet treats and chews made from natural animal parts have become a product safety concern to over half of dog and cat owners (see Figure 1).

FIGURE 1: A majority of dog and cat owners are concerned about the safety of their animals’ chews that include animal products, according to Packaged Facts data.

Whether addressing a specific condition or simply providing a wellness “superfood” or nutritional boost, functional treats form another growing segment of the treats market. In addition to catering to health-focused pet owners, functional treats appeal to value-conscious pet owners who are swayed by the idea of getting “2 in 1” in the form of treats that address health conditions. Functional treats aren’t marketed in a vacuum, however. Packaged Facts survey data show that while 30% of dog owners and 26% of cat owners purchase functional pet treats, many pet owners primarily or also rely on functional pet foods and pet supplements to address a variety of health concerns or conditions.

Addressing health concerns via treats

The health condition/concern being addressed helps to determine the product format pet owners are most likely to favor. In the skin and coat category, as reported in an earlier Petfood Industry magazine column on pet supplements, more pet owners choose pet foods targeting these conditions than either treats or supplements. Dental/oral health is the main category where treats come out on top in usage rates, mainly due to the mechanical cleaning effect treats can offer, which is difficult to attain with either a small supplement or a dry pet food (which dogs tend to gulp down, rather than chew).

Notably, in addition, many pet supplement marketers have begun “treatifying” their products, creating soft chew delivery systems that many pet owners use instead of treats. This has especially been the case with CBD (cannabidiol, derived from the cannabis plant) supplements, which in the human and pet markets alike are credited with treating a range of conditions. Pet owner interest in CBD centers on relieving anxiety and stress issues in pets, but owners also view CBD as an alternative treatment for issues including pain management and allergies. Packaged Facts’ survey data indicate that, among pet owners, 11% of dog owners and 8% of cat owners have used cannabis (CBD/hemp) supplements or treats for their pets.

Cat treat sales

In the treats category, many marketers have long neglected to fully cater to cats, or to remain as on-trend and innovative in cat treats as they are dog treat product launches. The infamously finicky eating habits of cats are partly to blame, causing their owners to be slow to shift to a new product once they’ve found a product their cat likes. Nonetheless, cat treat sales and usage rates have taken off notably in recent years, growing to 16% of the pet treats market as of 2019.