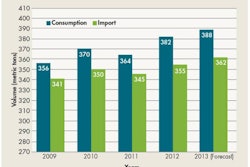

The volume of petfood produced globally in 2013 grew less than 1% over 2012, from 20.5 million tons to 20.7 million, according to the just released 2014 Alltech Global Feed Survey. That's slightly less than the 1% growth reported for production of feed for all species, from 954 million tons in 2012 to 963 million in 2013. Petfood makes up only about 2% of that global total.

While the petfood figure just shy of 21 million tons jibes with data from other sources, such as Euromonitor International, the Alltech report includes some individual country data that seems puzzling, if not off the mark. I suspect that's because of how Alltech conducts its survey: by sending 600 of its employees to visit 28,196 feed mills around the world. While that's impressive and thorough, that methodology probably does not hit all the players in petfood, particularly those that have modern facilities dedicated solely to producing petfood, as opposed to mills that also produce feed for several other species.

Thus, the report includes figures like zero petfood produced in Russia, even though it's one of the largest and fastest-growing petfood markets globally, or 2 million tons for Brazil, a decline from 2.5 million tons in 2012, according to Alltech -- yet Brazil has become the second largest petfood market (behind only the US) and is the fastest growing. Similarly, the report shows a decline for China (1 million tons in 2012, down to .2 million in 2013) while it's also among the fastest growing petfood markets, yet growth for Japan, from .315 million tons in 2012 to .6 million in 2013, despite the fact that Japan's petfood market has shown little to no growth over the past several years. In fact, that market declined after the terrible earthquake and tsunami in 2011.

Perhaps some of these discrepancies can be explained by corrections from the 2012 data? After all, that was the first year Alltech had included petfood in its survey. And, while petfood markets like China are growing quickly, they're starting from a very small base; that 1 million tons cited for China in 2012 might have just been too generous.

Outside of petfood, though, China reigns supreme in the feed world, coming in as the top producer at 189 million total tons. The second largest overall, the US, produced 169 million tons of total feed in 2013, with 8 million being petfood. Brazil ranked third at 67 million total tons, including that 2 million for pets.

From a regional standpoint, in terms of all feed, Asia by far is the top producer, at 348 million tons, with Europe second at 226.9 million tons and North America (apparently, just the US?) third with that 189 million tons. Africa is the fastest growing region for feed, according to Alltech, with a 7% increase from 2012 to 2013. Only .377 million of Africa's 31 million total tons was for petfood, the report shows.

Looking ahead, Aidan Connally, VP of Alltech, projects the global feed market to surpass the 1 billion ton mark this year. He has no specific comments about petfood; however, in a webinar last fall, Euromonitor projected petfood volume to reach nearly 24 million tons by 2018, with most of the growth coming in dry petfood because that's the type of product most prevalent in fast-growing markets like Brazil and Mexico. The latter market, by the way, also showed petfood growth in Alltech's survey, from .710 million tons in 2012 to 1 million in 2013, and also is the third fastest-growing market for cat and dog food sales, according to Euromonitor.