Pet food trends don’t just follow human food trends; in some cases, they’re getting to market faster as pet owners seek quality, healthful aspects and what’s next for their pets’ food bowls. So said James Restivo, client director and pet lead for Nielsen, in a webinar on how human food trends are impacting pet food formulations.

This is not a new insight, of course, yet it’s always fun and intriguing to think of pet food leading human food, rather than the other way around. What does that mean in terms of opportunities for brands to find the next big thing in pet food?

For consumers, it’s all about the ingredients

Restivo provided some data and information that might provide clues or ideas for what could come next for pet food. For starters, even though companion animal nutritionists and other experts always emphasize that the amount, quality and bioavailability of the nutrients are much more important than the ingredients that deliver them, ingredients are what consumers know and care about.

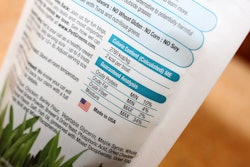

At least, they care about the ingredients listed on products more than they do product claims. Restivo discussed what he called the “flip”: when consumers encounter a new or different product, they tend to immediately flip the package over to study the ingredients and other information on the back. One reason for this behavior, he explained, is that many Americans don’t trust marketing claims on packages.

An example he gave was natural claims, which Nielsen data show just 15 percent of U.S. consumers always trust; 67 percent trust such claims only sometimes and 18 percent never trust them. He added that claims backed by regulations are more likely to be trusted, which helps explain the lack of trust for natural claims, especially those on human foods. (Currently, the Food and Drug Administration is looking at regulating such claims on human food; with pet food, there is a definition for “natural” established by the Association of American Feed Control Officials, but it’s debatable how strictly or consistently that’s enforced.)

As another example, Restivo presented data showing that while sales of pet food with joint health claims have declined 6 percent, products with glucosamine or chondroitin sulfate called out as ingredients have increased 3 percent and 6 percent, respectively. That’s because consumers recognize those ingredients and understand the benefits to their own health.

3 emerging human food trends for pet food to consider

While Restivo covered the most popular trends in both human foods and pet foods now — think clean label, superfoods and other functional ingredients, proteins and plant based — he also highlighted up-and-coming trends in human food that may also emerge for pet food:

- Where does it come from? Consumers increasingly include many factors and considerations in their decisions for which foods to purchase, Restivo said. They’re now thinking more and more about where the food and ingredients come from — where are they sourced? Is the food made sustainably? Such considerations are showing up in increased sales for human foods with claims related to sustainability and animal welfare, particularly grass fed and free range. In pet food, those claims still comprise very small categories but are also starting to grow, by as much as 156 percent year over year for grass fed proteins.

- Healthy indulgence. The trends of clean label and functional ingredients are appearing even in categories like snacks, desserts and candy. Similarly, even though Nielsen’s data show that U.S. sales of dog treats are flat overall, ones with claims like natural, grain free or with ingredients such as omega fatty acids, glucosamine or probiotics are seeing healthy growth.

- Back to basics. Similar to clean label, this emerging trend focuses on recognizable ingredient names and less processing. For pet food, Restivo linked the trend to fast-growing categories based on alternative processing methods: raw frozen and freeze-dried.

The next Greek yogurt for pet food?

For pet food brands looking to find new product and business opportunities, Restivo offered these recommendations:

- Recognize the complexity of the marketplace today and the decision-making process for health-conscious consumers, which includes their needs for transparency and information. Is there a way for you to lead in this area, including possibly with technology-based offerings?

- Ensure you understand how your marketing claims and especially the ingredients in your formulations will resonate with various segments of your customers — all within the framework of their seeking to manage their pets’ health and well-being.

- Then, clearly communicate the claims and ingredients that are important to your customers, keeping in mind trends that continue to grow like clean label and “free from” claims.

In response to a question about whether cannabis-based products (for pets or humans) might become a big success, Restivo answered more generally: In most cases of a trend really taking off — for example, Greek yogurt — it’s because one company or a few companies decided they were going to take a niche category and turn it into a US$500 million industry. They made that a business strategy and executed it very well. Is there a niche category in pet food that could follow that model?