The pet food market has not just weathered COVID-19, it has thrived. Packaged Facts projects U.S. retail sales of pet food (dog and cat) at US$37.1 billion in 2021, up 6.4% from US$34.8 billion in 2020.

Dog food accounts for two-thirds (66%) of retail dollar sales of dog/cat food, with cat food making up the 34% balance. Several factors account for this spread: the dog population in the U.S. is larger than the cat population; dogs on average are larger and therefore consume more pet food; and pet food premiumization is more fully developed on the dog side of the pet food aisle.

Dollar sales growth in the pet food market overall can primarily be attributed to:

- The pet care spending boom and new pet adoption in the wake of COVID-19.

- The intertwined rapid acceleration of online sales, driven especially by Chewy and Amazon, whose swift advances have been more than offsetting the resultant drag on brick-and-mortar sales.

- Pet food premiumization, which remains a growth driver as pet owners continue to trade up to products including formerly pet-specialty-exclusive and similar brands now available in mass channels, as well as to fresh pet food options including refrigerated and freshly prepared.

Pet food trends and growth

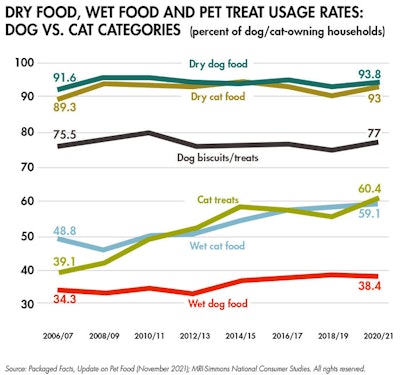

From a bird’s eye scan of historical usage rates, several trends are evident in pet food and treats. Premiumization and even reinvention of products have driven the growth in dry pet food and in dog treats, along with increases in pet population. Purchasing rates for dry pet food, given that it is nearly universally used, remain flat. Purchasing rates for dog biscuit/treats, similarly, have remained pretty flat. There’s not much to see here.

As Packaged Facts reports in “Cat Market Opportunities” (November 2021), the real growth in usage rates shows up on the cat — not dog — side of the pet aisle. Usage rates for cat treats have been on a tear: from 39% in 2006–2007 to 60% as of 2020–2021 (see Figure 1). In addition, purchasing rates for wet cat food have risen from 49% to 60% over this period. The dog-centric success of fresh pet food marketers, moreover, is likely to spur corresponding product development for felines.

FIGURE 1: While there is growth in each category, the most significant growth over the years appears to be cat food products: dry, wet and treats have all risen significantly in usage since 2006.

Fresh pet food can be seen as the ultimate version of wet cat food, if not pet food overall. Wet cat food has historically claimed higher usage rates than wet dog food. One factor is that dry food is a better value by price, and in terms of pet size it costs more to feed wet food to a Golden Retriever than to a cat. Also, cats benefit more from wet foods due to hydration issues. Wet cat food, partly because it is more often on hand, also serves more often as a treat. Cat treat usage rates, correspondingly, have historically trailed dog treat usage rates — though the relative finickiness of cats about packaged treats, compared with dogs’ often boundless enthusiasm for receiving them, also plays a role here.

To a degree, given that wet pet food vis-à-vis dry can be dispensed (or can top kibble) as a treat, wet food and pet treats flip roles in the dog vs. cat food categories. While use of wet dog food has edged upward, purchasing rates for wet cat food remain significantly higher and are rising faster. In turn, while the use cat of treats has jumped, usage rates for dog biscuits/treats remain significantly higher.

More generally, across the board: Unlike the lion’s share of mature packaged foods categories, pet food and treats should continue to post robust growth rates for years to come.

Cat food expanding as innovations grow in the segment