A new survey of dog owners by a UK-based pet supplies website shows the quality of petfood outweighs costs for many pet parents, echoing ongoing premiumization in the US petfood market and mirroring purchasing drivers for human food.

Conducted online by GJW Titmuss from October to December 2013 and responded to by 675 dog owners, the survey showed 61% of the owners consider quality the most important factor when choosing a dog food, versus only 9% choosing cost. (Brand was the only other factor mentioned as a response, at 7%.) In addition, 74% of the respondents said they purchase "top quality, premium petfood products" (terms were undefined in the survey report) and 28% said they buy specialty products to help address health issues such as skin problems, obesity, sensitive stomachs or old age.

The report did not include any demographic information about the survey respondents; considering it was conducted online, they could live and purchase petfood anywhere. But with GJW Titmuss being a longtime UK retailer, doing business in that sector since the early 1900s, one can guess that most of the site's shoppers and, thus, survey respondents, are based in the UK.

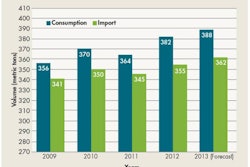

As such, their petfood purchasing decisions and patterns are similar to those in other developed markets, such as the US, as shared by David Sprinkle of Packaged Facts. For example, Experian Marketing Services data shows that 57% of pet owners shopped in the pet specialty channel as of 2013, up from 53% in 2010. The growth in share for that channel has come at the expense of US supermarkets, whose share of pet product shoppers declined from 50% to 46%, and discount stores, which showed a decrease from 29% to 26%. Further, dog food sales in US mass market outlets (excluding Walmart) dropped 5% year over year in the third quarter of 2013, according to IRI, while mass market cat food sales decreased 2%.

These petfood buying patterns march in lockstep with those for human food. Healthfulness was the most important food selection factor for 64% of American consumers, according to an IFIC survey conducted in 2013 (and cited by A. Elizabeth Sloan in the January 2014 issue of Food Technology.) While taste, at 88%, and price, at 71%, ranked higher for these food shoppers, healthfulness increased three percentage points in importance compared to 2012, while price dropped seven points from 2011 to 2013.

On a global level, number two on Euromonitor's top 10 global consumer trends for 2014 is eating right, which encompasses not just weight control but also people's intent to improve their quality of life and longevity. Euromonitor says that a survey it conducted in 2013 showed that "online consumers are willing to pay more for food items with specific benefits, such as added nutrients." Similarly, those dog owners purchasing premium dog food from GJW Titmuss are also heavy online shoppers; that survey indicated 85% of dog owners who purchase from the site use only the internet to buy petfood.

In comparing dog food owners globally, another similarity stands out, though this one seems unfortunate. In the GJW Titmuss survey, a full 94% of respondents characterized their dogs' weight as "average," even though veterinary experts in the UK estimate up to 50% of UK pets are overweight. In the US, 52.5% of dogs and 58.3% of cats are considered overweight or obese, according to the Association for Pet Obesity Prevention (APOP). At least not as many US pet owners are in denial, with 45% of respondents to an APOP survey saying they consider their pets' weight to be normal.