Big Heart, we hardly knew ye. Not quite a year ago, you announced yourself to the petfood world as the new name of the company formerly known as Del Monte--a name, you said at the time, chosen to "reflect the company's singular focus on the pet products market and underscore the company's purpose: nurturing the bond between pets and the people who love them, making every day special."

That so-called focus came about just four months earlier, when Del Monte divested its iconic human foods business. Well, so much for a singular focus on pet products--because now the Del Monte/Big Heart Pet Brands business is moving back under the umbrella of a large human food company, J.M. Smucker. The US$5.8 billion deal, announced yesterday, eclipses last year's petfood blockbuster of Mars Petcare buying most of Procter & Gamble's petfood business (for US$2.9 billion).*

For Smucker, the deal marks its first foray into the petfood or pet business and, according to a post by Michael J. de la Merced on the New York Times' website, should give the company's lackluster sales a "shot in the arm," adding US$2.2 billion in sales. (According to the Petfood Industry Top Petfood Companies Database, Big Heart Pet Brands had sales of US$1.9 billion in 2013, the latest full-year data available in the database; the US$2.2 billion figure probably reflects 2014 sales and/or sales for other pet products besides petfood or treats.)

The deal also underscores the attractiveness of the dynamic petfood market to people and companies based in other industries, such as human food. "Its not uncommon at all for leaders in the industry to be in human food and petfood," de la Merced quoted Richard Smucker, CEO of Smucker, as saying. "Petfood is one of the fastest-growing areas in the center of the store."

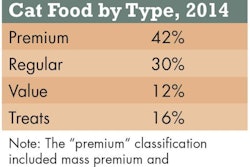

Actually, petfood sales growth slowed in 2014, though market experts predict it to pick back up this year, to at least 3%, and beyond. However, any growth in the US petfood market is happening mainly in the pet specialty channel, not mass market, where the Big Heart brands tend to be distributed. In fact, according to 2014 data from IRI, US mass market dog food sales increased only 0.2% in 2014, with cat food up only 0.7%.

So, this may not be the boost Smucker had hoped for. Or, while CEO Smucker described the deal as "one of the most transformational in the company's 118-year history," let's hope it won't transform the company in a negative way. As for Big Heart/Del Monte, I suppose US$5.8 billion can help it readily forget its boast a year ago of being the "largest standalone petfood and snacks company in North America."

According to de la Merced's reporting, the deal has been in the works since August 2014, with its origin dating back to fall 2013 when Del Monte was seeking to divest its human food brands and David West, the company's chairman, asked Smucker if he was interested. He wasn't, at least not in the human foods business--but he did tell West to give him a call if the Del Monte chairman was ever interested in selling his petfood business.

The call came last August. "At the time, Big Heart was considering whether to go public as an independent company or to sell itself to a bigger food manufacturer, quietly reaching out to a small group to gauge their interest," de la Merced wrote.

West will continue to lead the petfood business, de la Merced continued, and will become a director of Smucker. He's definitely the winner in this deal. There's no word yet available on how the move will affect the thousands of Big Heart employees working under him.

Nor is any information available as to whether the Big Heart Pet Brands name will continue on--though most of its products are marketed under their own brands, themselves iconic: Milk Bone, 9-Lives, Meow Mix, Kibbles 'n Bits, to name a few. For icons, they sure do get moved around a lot, don't they?

*Update: Some sources are reporting the deal to be for US$3.2 billion. The US$5.8 billion total includes US$2.6 billion in net debt that Smucker is taking on as part of the deal.