We’ve entered the trend-watching season, and right on cue, lists of human food trends for 2019 are popping up. Not all have implications for pet food, but some do merit tracking.

Protein still key for humans and pets

For example, during a November 7 webinar on health and wellness in human nutrition, Sarah Browner, market analyst in food trends and innovation for Innova Market Insights, discussed a trend familiar to pet food brands: powered by protein. In the human food world, the number of new food and beverage products with protein claims launched globally rose from an indexed base of 100 in 2013 to nearly 300 in 2017. Browner also said that nearly 50 percent of UK consumers are influenced by protein when buying food products, according to a 2018 survey.

Additional Innova data showed that plant protein claims had garnered a 24 percent share of new human food product launches globally by 2017, with North America having the highest percentage of such products while other regions, such as Asia and Eastern Europe, were showing strong growth in claims. In fact, they’re on the rise in all regions worldwide.

Perhaps more pertinent to pet food, Browner’s data also indicated the fastest growing plant protein for claims from 2015 to 2017 was pea protein, increasing 23 percent, with potato protein showing 14 percent growth. We know usage (and claims) of peas and potatoes have been growing in pet foods over the same period and before, particularly in grain-free products, and may be a factor in the number of atypical cases of canine dilated cardiomyopathy being investigated by the Food and Drug Administration and veterinary experts this year.

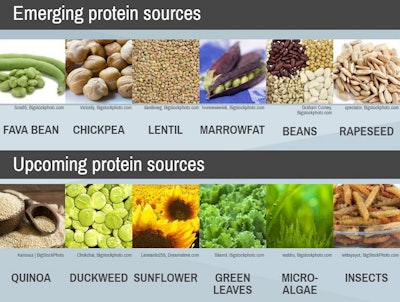

From alternatives to small and connected

Browner’s colleague, Lu Ann Williams, also touched on protein in her annual webinar announcing Innova’s top 10 trends for the coming year, highlighting human foods with alternative proteins like peas, water lentils (a newer source) and cricket powder. While Williams said she has been surprised by the increasing appearance of insect protein — “It has a bit more legs than I thought it would,” she commented, apparently without intending a pun! — she also shared data showing that 50 percent of U.S. consumers say they buy alternatives to traditional dairy and meat products not just for health reasons but also because they are attracted to novelty and variety. (That plays into Innova’s top food trend for 2019, discovery). Sustainability also plays a role here.

A few other human food trends presented by Williams, director of innovation for Innova, resonate for pet food:

- Snacking — we know pet treats continue to expand, not only in sales but also in the number of products launched, ingredients included and corresponding benefits claimed. (Think proteins and functional ingredients.) On the human side, Williams said a survey showed 63 percent of millennials are replacing meals with snacks because they’re busy, 50 percent of Gen X-ers are inclined to cut down on sweet snack consumption and 67 percent of boomers are making changes in their snacking to be healthier. (She didn’t indicate if this data was global). Snacking is no longer the “optional extra” for human food brands, she said. “How do you ‘snackify’ your brand?”

- Eating for me — though still niche, personalized nutrition will continue to become more important, Williams said. The same seems true for pet food, as more companies offer customized dog foods and similar individualized diets.

- Small player mindset — discussing Innova’s top 2019 trend of discovery, Williams commented that it’s being driven by smaller companies experimenting the most with flavors, textures, packaging, dining experiences and even temperature changes. She also singled out small players as their own trend, powered by consumer desire for local connections as well as start-up investments; at the same time, these smaller companies are inspiring the food giants. This all sounds very familiar to what we’ve been seeing in pet food for several years now, which has also helped keep mergers and acquisitions going strong.

- Connected to the plate — technologies like the Smart Label on human foods and blockchain are just starting to be discussed for pet food, yet they definitely have just as much potential in our market.

Flashing the green

Another trend for human foods that seems to draw parallels with pet food is around “green appeal,” or sustainability. According to an Innova trends survey conducted this year, 64 percent of U.S. and U.K. consumers expect brands and companies to invest in sustainability, Williams said. She gave examples of human food brands using upcycled brewers grain in snack bars or replacing plastic packaging with that made from edible seaweed.

Mintel takes this a step further, naming “evergreen consumption” as one of its top three global food and drink trends for 2019 and elevating it to a circular view of sustainability that spans the entire product lifecycle and requires actions from suppliers to companies to consumers. “From farm to retailer to fork to bin and, ideally, to rebirth as a new plant, ingredient, product or package, this 360-degree approach will ensure resources are kept in use for as long as possible,” said a Mintel press release.

With pet food, it’s unclear how much pet owners care about sustainability in terms of ingredients and similar areas; claims related to ingredient sourcing and animal welfare, such as grass-fed beef, are still very small but growing at 156 percent a year, according to Nielsen data. Interest in sustainable pet food packaging also seems to be growing. Research conducted by Tetra Recart earlier this year revealed that 43 percent of consumers said an environmentally sound package made them much more likely to consider the brand, while half said it makes the brand worth more than it cost, according to Blaine Johnson, business development director.