If all the disruptions happening in pet food now, including in pet food retailing, haven’t really registered yet, consider this: In the last four years, the consumer product goods industry (which includes pet food) in the U.S. has lost US$40 billion dollars to direct-to-consumer (DTC) sales. So said Chris Hamilton, president and CEO of Red Collar Pet Foods and a panelist for a Petfood Forum 2019 discussion on changes in pet food retailing, including e-commerce.

Hamilton added that these huge losses weren’t all due to e-commerce, though that’s certainly part of it. And he didn’t provide data (if it’s even available) on what share of that figure belongs to pet food. Yet the point that he and other panel members made definitely applies to pet food: Traditional ways of getting a product into the hands of consumers have been joined and often usurped by many other methods and channels, none of which are stagnant or guaranteed to last forever; and consumers are not likely to depend on just one channel. That’s just not the world we live in anymore.

“We need to start thinking that consumers are channel agnostic,” said Nathan Marafioti, group director of e-commerce for Nestlé Purina North America and another panelist. “They go wherever it’s most convenient at the moment, or to the best price if that‘s what’s important to them at the time. We’re used to thinking retailer first and not consumer first, and we need to shift.”

E-commerce’s role in pet food growth and what’s driving it

It’s a very good bet that for most consumers, e-commerce will be at least one of the channels they consider or use to research or buy their pets’ food. Ed Yuhas, managing partner with Kincannon & Reid Executive Search and the panel moderator, pointed out that while pet food e-commerce comprised only 11% of U.S. pet food sales in 2018 (citing data from Nielsen), or US$3.6 billion, the channel’s growth clocked in at 53%. This growth rate far outpaced that for any other channel – the next “largest” was mainstream retail (mass market outlets, grocery stores, etc.) at 1.7% — and even for the entire U.S. pet food market, which increased 5%.

If e-commerce is the engine driving pet food market growth, then Amazon is the “beast” fueling that growth, according to Profitero, an e-commerce performance analytics platform. In its recent report, “The Amazon Playbook for Pet Brands,” the firm included data from several sources (Statista, Packaged Facts and the American Pet Products Association) showing that Amazon accounted for 55% of all pet product purchases (not just pet food) in 2018. Chewy.com, while a key player, came in a fairly distant second at 31%, followed even further behind by PetSmart.com (15%), Petco.com (13%) and Walmart.com/SamsClub.com (11%).

Specific to pet food, Profitero’s own data showed strong sales growth on Amazon in all major categories: 25% for cat treats, 24% for dog food, nearly 20% for dog treats and 15% for cat treats. The Amazon marketplace is allowing even small pet food and treat players (US$500,000 to US$1 million in annual Amazon sales) to achieve significant growth, the report said. For example, EcoKind Pet Treats experienced 815% year-over-year growth in 2018, with Lilly’s Choice growing at 415% and Brazilian Pet, 144%.

Larger brands (Amazon sales of more than US$10 million) may not be enjoying that level of soaring growth but are still increasing nicely, according to Profitero. That includes Rachael Ray Nutrish at 56%, Royal Canin at 35% and Iams at 34%.

5 ways pet food brands can win on Amazon

Mike Black, vice president of global marketing for Profitero, presented information from his company’s “playbook” during Petfood Forum 2019. His and Profitero’s sights are set squarely on Amazon and how pet food brands can join and succeed on the platform because of its dominant position in today’s retailing landscape. “It’s imperative you make Amazon your priority today,” the report said.

To do that, Profitero offers these key tips and tactics:

- Make sure your product is in stock when pet owners look to purchase. “Aggressively monitoring out-of-stocks and fixing inventory issues is a quick and cost-effective path to boosting e-commerce sales,” according to Profitero. And that applies to all online retailers through which you sell your pet foods, not just Amazon.

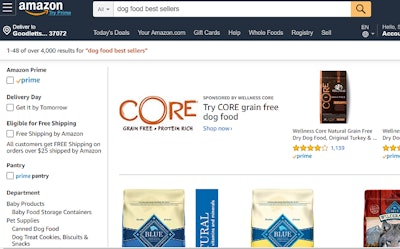

- Ensure your brand or product appears on the first page of search engine returns. Or, as the report put it, “If you’re not on page 1, you’re invisible.” It’s not absolutely necessary to be at the top of page 1, though that helps; the priority is to make sure you’re on the first page by using strong keywords, sponsoring highly searched category words and other search engine optimization (SEO) tactics.

- Leverage Amazon’s unique traffic-driving events. This includes Cyber Monday and Prime Day, for example.

- Focus on content that converts browsers into buyers. “To boost conversion, start by identifying products in your portfolio with significant conversion upside (i.e., those getting high traffic but have sub-par conversion rates),” the report said. “Then focus on improving product content and ratings and reviews for those products.”

- Use benchmarks to guide your content. Benchmark against your competition and the category best-sellers before making content changes. For example, for pet food, Amazon best-sellers have these averages: 901 reviews, a 4.3-star rating, nine images and a character count of 70 in their titles, according to Profitero’s data.

In addition to this report, you can download a free Amazon FastMovers Data Report from the Profitero website.