Recently the U.S. Bureau of Labor Statistics (BLS) released U.S. inflation data for March 2022, and the news (not good) spread fast and wide: The Consumer Price Index (CPI) rose 8.5% compared to 2021 levels, the largest increase since 1981. How did pet food fare?

Also not good. Pet food inflation increased 5.9% vs. March 2021 and 2.3% over February 2022, according to BLS data shared and analyzed by John Gibbons, aka the Pet Business Professor. “They are being measured against a deflationary year, but that increase is almost triple the pre-pandemic 2.1% increase from 2018 to 2019,” he wrote.

For the overall pet care category, inflation surged 7.5% compared to 2021, not far below the overall 8.5% CPI increase. In December 2021, Gibbons noted, the “petflation” index was up 4.1% year-over-year (YOY), lower than the 7% CPI at the time; so since then, the gap has narrowed significantly.

Pet owners, and pet food producers, feeling rising prices

While pet care and pet food inflation still lag behind that for other staple categories such as food at home (10%) and its subcategories like meat, poultry, fish and eggs (13.7%), and fruits and vegetables (8.5%), the ongoing rise in pet food and pet product prices is a concern. And it’s affecting pet owners and consumers overall.

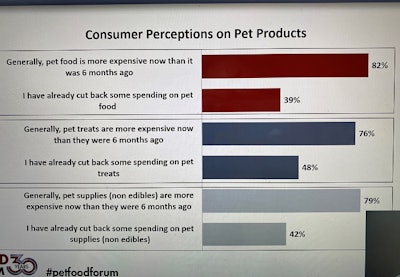

Michael Johnson, CEO of Finn Cady and a pet market expert, cited data from an April 2022 survey of U.S. dog and cat owners showing 48% believed the economy was good for them just six months ago (fall 2021), but now just 27% do. Specific to pet owners, 82% of respondents in the same survey believe pet food is more expensive than it was six months ago, and 39% are already cutting back their spending on it. Similarly, 76% think pet treats are more expensive than six months ago, with 48% having cut back their spending on treats.

(Note: Johnson will be speaking on consumer marketing of pet food at Petfood Forum 2022 on May 3 in Kansas City.)

As you are probably acutely aware, pet food manufacturers are suffering from inflation, too. According to Producer Price Index data shared by Gibbons, prices for dog and cat food manufacturing soared 8.9% in March 2022, the largest YOY monthly increase since 2009. Breaking that down, dog food manufacturing was at that same level (8.9%), cat food rose 10.5% and for other pet species, the increase was 12.5%.

Ongoing storms, with some good news sprinkled in

Unfortunately, pet owners and consumers in general, along with the pet food industry, will likely keep feeling the pain of rising prices for the near future. Some economic experts believe relief, but not the immediate end, may be in sight.

Paul Krugman, a professor of economics and longtime columnist for the New York Times, said recently that the March 2022 inflation report may have presented a somewhat misleading picture, because “living on COVID time,” things are still changing very quickly. The CPI this time, he wrote, “probably missed a downward turn that began in late March and is accelerating as you read this. Inflation will probably fall significantly over the next few months.”

Yet Krugman also cautioned that we shouldn’t get too excited by this, because the improved numbers don’t completely mitigate the fact that the U.S. economy (including wages) is still “overheated,” and some good news may be offset by a return of negative factors.

For example, he linked to an article by Greg Miller on American Shipper/FreightWaves.com explaining that, though the bottleneck at U.S. West Coast ports has started to ease—the “queue of ships waiting for Southern California berths fell. Velocity of cargo moving through terminals increased. And more boxes were unloaded at Southern California docks.”—this could be the calm before another storm, as a new COVID-driven shutdown of a major port area in China, Shenzhen, could dramatically slow global shipping again.

The bottom line, according to Krugman, is that we will still be dealing with inflation for some time, but he doesn’t believe it will become entrenched as it was in the 1980s, which was partially spurred by consumer expectations. “Consumers expect high inflation in the near future, but medium-term expectations haven’t moved much, suggesting that people expect inflation to come down a lot,” he wrote. “If you think today’s report showed inflation spiraling out of control, you’re wrong. In fact, we’re probably about to get some misleadingly good news on that front.”

In other words, pet food consumers, manufacturers and suppliers need to strap in for an ongoing rocky ride, but it may start to smooth out later this year.

Note: This post has been updated to include the information on the survey from Michael Johnson of Finn Cady.