For marketers across the entire pet industry spectrum, the growth of the pet population is of utmost importance, and in this regard the US market could use a boost. From 2009 to 2010, the overall rate of pet ownership decreased slightly, from 54% of US households to 53%. Dogs, reptiles and fish were the only segments to increase, and the dog increase from 36.7% to 36.8% was almost negligible.

Some of this sluggishness owes to the weak economy; but the longer term 2007-2010 trends make it clear that pet ownership has not been growing by leaps and bounds, with the percentage of dog-owning households up only 1 point since 2007 and the cat percentage down a point.

This weakness is partly a function of below-average pet ownership rates in segments including seniors, young adults and ethnic/racial minorities. These trends must be addressed now if the market is to thrive in years ahead, because each percentage point of household penetration of pet ownership currently yields roughly US$1 billion in annual sales of pet products and services.

According to Experian Simmons, approximately 50% of US households owned dogs or cats as of 2010, with ownership rates ranging from a high of 59% in the 35-44 and 45-54 age segments to a low of 36% in the senior (65+) segment. After seniors, the ownership rates are lowest among the youngest adults, those age 18-24, while those age 25-34 or 55-64 are right at the norm. The overall pattern is one of rising pet ownership through age 54, followed by a sharp drop-off in the age 55-64 segment and an even sharper drop-off at the 65+ level.

Of the six age brackets, only two increased significantly in household ownership of dogs or cats from 2005 to 2010, with those age 35-44 rising from 53% to 59% and age 45-54 rising from 56% to 59%. This means attention must be paid to both the youngest and oldest population segments, both of which are essential to future market growth.

The number of minority (i.e., other than White Non-Hispanic) dog or cat households rose 26% from 2005 to 2010, representing the addition of 2.1 million minority households, but minority groups remain sorely underrepresented as pet owners. As of fall 2010, the household dog/cat ownership rates were at 40% for Hispanics, 20% for Blacks and 23% for Asians, compared with 58% for White Non-Hispanic households.

Hispanics are 20% below average in dog/cat ownership (index of 80), Blacks are 59% below average (index of 41) and Asians are 54% below average (index of 46). As a result, White Non-Hispanic households account for 82% of all US pet owners as of 2010, with Hispanics at 9%, Blacks at 5% and Asians at 2%. (The figures total 98% because other races and non-responses are not cited.)

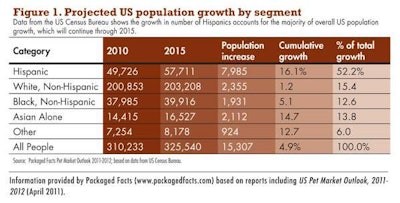

Given that minority groups represent a fast-growing share of the US population, these disproportionately low rates of pet ownership signal a potential problem for the pet industry down the road. According to the US Census Bureau, Hispanics grew to 49.7 million, or 16% of the total US population, in 2010, and they are projected to number 57.7 million by 2015, when they will account for 19% of the US population. Also growing faster than White households, the African-American/Non-Hispanic population will number 40 million in 2015, or more than 12% of the population, and Asians will number approximately 17 million, or 5% of the US population.

In many consumer packaged goods markets of a size comparable to petfood, youth, senior and minority-targeted products and advertising are an essential thrust, and this will need to be the case in the pet market as well in order to not miss the steady and not-so-slow swing away from this market’s traditional base. In particular, marketers should begin to home in on Hispanics.

From 2010 to 2015, Hispanics will account for 52% of US population growth, and this share will climb steadily upward through 2050, when Hispanics are expected to account for almost one-third of the US population.

Based on the advances in pet ownership noted above, Hispanics appear to be ripe for development as pet owners, partly as a function of their ongoing Americanization. But clear-cut Latino initiatives—the most obvious being Spanish-language advertising, promotions and product labeling—will almost certainly expedite the process of bringing this highly family-oriented group into the pet ownership fold and keeping them there.