During the latest Petfood Forum and Petfood Innovation Workshop, held in Kansas City, Missouri, USA, novel proteins in pet food were an understandably hot topic. Pet owners are paying more attention than ever to what their pets eat, and as they increasingly focus on the individualized nutritional needs of their animals, traditional proteins such as chicken, beef, pork and lamb are no longer the only options on their radars.

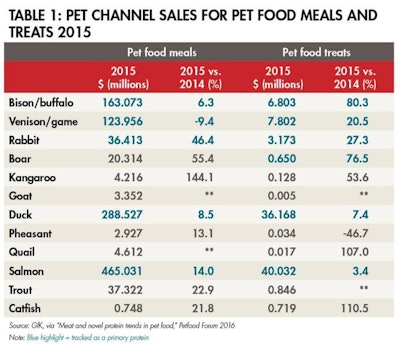

According to David Sprinkle, research director at Packaged Facts, who opened the Petfood Innovation Workshop 2016 with his presentation, “Meat and novel protein trends in pet food,” pet channel sales for pet food meals including novel proteins (which may also be called exotic or alternative proteins) increased across the board from 2014 to 2015. GfK data show that salmon and duck saw the most significant gains, even when tracked as a primary protein in pet food: salmon sales increased by US$57.2 million (14%) and duck sales increased by US$27.5 million (8.5%). Taking a look at novel proteins that gained the most sales percentage-wise in pet food brings in a different set of meats: kangaroo (144.1% growth, to US$4.2 million in sales in 2015), boar (55.4% growth, to US$20.3 million) and rabbit (46.4% growth, to US$36.4 million) all saw significant jumps in their popularity from 2014 to 2015 (see Table 1).

There were some significant increases in sales among novel proteins from 2014 to 2015, according to GfK data. Diets with kangaroo in them, for example, saw the largest jump in sales—144%—bringing in US$4.2 million in 2015.

Pet treats haven’t seen the same kinds of gains in novel proteins, according to Sprinkle, but it’s clear the interest is there: treats with catfish as an ingredient saw a 110.5% increase in sales between 2014 and 2015, to US$134,000, and quail saw a 107% increase, to US$4.5 million. While even the most significant gains in sales were small compared to pet food (between US$1.3 and US$3 million for treats with salmon, venison, duck or bison as ingredients), it’s clear that novel proteins have a growing place on pet store shelves.

Why are novel proteins becoming more popular? According to Mark Mendal, founder of consulting firm Pet Proteins, who spoke on “Novel proteins: Their role in the future of our industry” at Petfood Forum 2016, one of the main reasons is that they are largely healthier than conventional proteins.

Pet health via nutrition is a flourishing market these days. As pets continue to be treated like members of the family, they are eating better—and getting larger. According to the Association for Pet Obesity Prevention, an estimated 58% of cats and 54% of dogs in the US are overweight or obese. Pet obesity can cause a whole host of health problems, including osteoarthritis, diabetes, heart and respiratory disease, and an overall decreased life expectancy. The solutions to pet obesity are largely the same as in humans: diet and exercise. The diet side of things is where novel proteins come in.

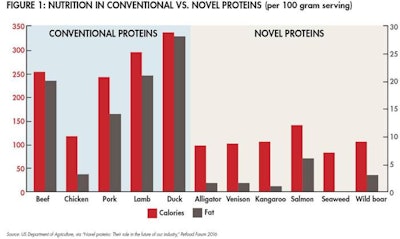

Overall, novel proteins have fewer calories and less fat than conventional proteins, according to Mendal (see Figure 1). Lamb, beef, pork and chicken, for example, have 294, 254, 242 and 119 calories, respectively, per 100-gram serving. Even the most calorie-laden novel protein on the market, however—salmon—only comes in at 142 calories per 100-gram serving, with most hovering at 100 calories or fewer (seaweed, predictably, has the least, at 82 calories per serving). The story is the same for fat content among proteins. Where conventional proteins are somewhere in the 20 grams of fat per 100-gram serving range (the exceptions being chicken, at 3.1 grams, and pork, at 13.9 grams), novel proteins for the most part have very little fat at all (salmon is, by far, the highest, at 6.3 grams of fat per 100-gram serving). Again, seaweed has the least, with 0.3 grams, but the majority of novel proteins seem to have less than 3 grams of fat per 100-gram serving—not an insignificant difference when pet owners are looking to keep their pets healthy and slim.

By and large, novel proteins have lower caloric and fat contents than conventional proteins such as chicken, beef and pork—good news in the eyes of pet parents dealing with pet health issues such as obesity.

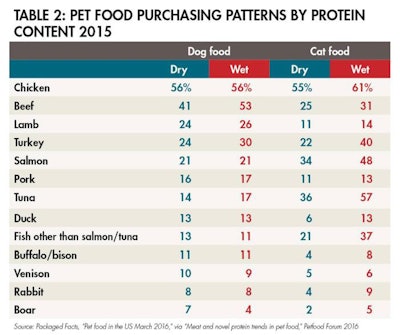

How does all this play out on the pet food market? According to Sprinkle and Packaged Facts, conventional proteins still carry the majority of the market. More than half of all dry and wet dog and cat food purchased contain chicken (see Table 2). Beef can be found in 53% of wet dog food purchased and 41% of dry dog food, as well as 31% of wet cat food and 25% of dry cat food. Some proteins that are more novel in dog food might be considered more standard in cat food: for example, salmon can be found in 48% of wet cat food and 34% of dry cat food purchased, while it’s only found in 21% of both wet and dry dog food. And tuna, which is found in more than half of all wet cat food purchased and 36% of dry cat food, shows up in just 17% and 14% of wet and dry dog food, respectively.

While conventional proteins still dominate the pet food market, many novel proteins have entered the playing field, including boar, rabbit, venison and buffalo.

The numbers get smaller among the novel proteins, according to Sprinkle, but not insignificant: Various fish, buffalo/bison and venison can all be found in more than 10% of dog food purchases, while buffalo/bison, venison, rabbit and boar can be found in more than 5% of cat food purchases. Novel proteins have more than low calories and low fat on their side, as they play almost exclusively into the specialty pet food market. Claims such as natural, organic, holistic, ancestral or limited ingredient can often be tied to novel proteins, as can diets that are grain free, by-product free, soy free and/or low carb. As these claims continue to gain traction and carve out their niches in an ever-changing market, it’s likely that the call for novel proteins will grow alongside them.

More on novel proteins in pet food

Pet food’s future may depend on new, old proteins: http://goo.gl/6A7xzK

Novel meat proteins gaining importance in pet food: http://goo.gl/bTOzUa

Crickets becoming new protein source in pet treats: http://goo.gl/VbOHLg

Consumers’ education needed on benefits of novel proteins: http://goo.gl/sDaFWT

Novel proteins showcased at Petfood Innovation Workshop: http://goo.gl/Fk1nGV