It is estimated that over 20,000 new products are launched every year within the food market (see Figure 1). Claims such as “natural,” “free of chemicals,” “free of preservatives” and “no artificial components” are at the top of the list for many of these newly launched products. These types of claims are made because marketers believe that the current food market is being driven by health-conscious consumers who are in search of wellness—a state of healthy balance between body, mind and spirit—as they age.

More than 20,000 products are launched in the human food and beverage market each year, according to historical data.

Food product developers (and others in the food industry) are catering to different populations and demographics. Developing new food products based on available scientific evidence of efficacy is not just to satisfy the needs of the Boomer generation but also to satisfy the Millennials. The increase in life expectancy to an average of 78.9 years provides new opportunities as well as new challenges for food manufacturers. The oldest boomer turns 70 years old this year (2016) and the oldest millennial will turn 35 years old. These are two strong consumer demographic forces in the marketplace and, though different in their needs and lifestyles, they both have something in common: they seek optimum quality of life.

Aging as a primary demographic concern

As these two demographic groups age, the demand for innovative solutions to age-related health issues will continue to increase and, as a consequence, the concept of functional ingredients and nutraceuticals (ingredients that provide physical and mental health benefits beyond nourishment) has taken on a life of its own. It is estimated that by the year 2050, 30% of the US population will be 65 years of age and older. Similar trends are expected in other regions of the world.

Aging, however, brings with it the onset of a number of ailments (Alzheimer’s, arthritis, cancer, etc.), and the objective of healthy aging and wellness is to extend “functional” life span years to minimize impaired mobility years. Can food be used as a strategy to prevent, or delay, rather than treat common ailments? Are the lines between pharmaceuticals and foods crossing? This is the area where we will see a lot of future development.

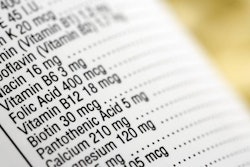

“Root extracts,” “plant extracts,” “probiotics,” “prebiotics,” “antioxidants” and “omega-3 fatty acids” are typical industry buzzwords claiming increased physiological and nutritional functionality that benefit the nervous, circulatory, endocrine, digestive, skeletal and immune systems.

Improvement of eye function and vision is associated with lutein, lycopene and DHA omega-3 fatty acid. Antioxidants are marketed as biological quenchers of free radicals that protect against various diseases, while chondroitin sulfate and glucosamine are thought to be helpful for cartilage synthesis. Antioxidant minerals like organic selenium have shown potential as therapeutic agents in neurological disorders with increased oxidative stress (Lovell et. al, 2009).

Functional food ingredients and life span: their relation to the pet food industry

The same health-conscious Boomers and Millennials are driving the need for innovative nutritional solutions for their companion animal aging issues. As pet parents age, so do their pets. According to Banfield Pet Hospital’s 2016 State of Pet Health Report (a summary of 2.5 million dog and half a million cat visits in 2015), a number of medical conditions such as arthritis are on the rise, particularly in older pets.

It has been estimated that over 3,300 new products are launched every year (GfK 2016) in the pet food segment; a bit lower than the food industry but nevertheless a growing trend. Pet food product developers and marketers will need to go through the available scientific evidence to make the right choices to properly substantiate their claims. We see ingredients like probiotics (Lactobacillus bacteria), prebiotic fibers (Beta-glucans, Manna oligosaccharides), nucleotides and omega-3s fatty acids (algae sourced), glucosamine and chondroitin sulphate added to pet foods.

Some of the most innovative companies follow what is known as the S-curve (see Figure 2) and develop technologies and applications to improve their market offerings, such as algae-derived biomolecules, beta-glucans and nucleotides. Beta-glucans are widely distributed in nature and one of the most important sources is derived from yeast.Beta-glucans are reported to have immune stimulatory, anti-inflammatory, anti-microbial and anti-tumor properties as well as a cholesterol-lowering activity.

Some companies focusing on innovation follow what is known as the S-curve to develop technologies and applications to improve their market offerings.

Omega-3 fatty acids derived from algae are a new market offering that address sustainability. With the global population expected to reach 10 billion in the year 2050, algae can be used as a vector to express a number of essential nutrients. Nowadays, specific strains of algae expressing high amounts of DHA already exist. In the near future, we should see other strains expressing different fatty acids, vitamins, glucosamine, phenolic compounds and antioxidants, as well as other functional ingredients.

The future outlook

Will there be a shortage of protein in the future? Time will tell, but there are protein bars made with cricket meal on the market already. The possibility of growing meat cells in a lab has become a reality; though cost is prohibitive, perhaps in the not-so-distant future meats for ourselves and for our trusted four-legged friends will come from a lab (made to order).

We are living in interesting times; we are in the midst of a new age where science and technological breakthroughs allow us to provide food and ingredients that go beyond basic nourishment of the planet, people, pets, plants and animals.

Meeting the demands of pet humanization