In a small corner of northwest Germany, Dr. Jürgen Wigger and his sister Ulrike Petershagen are carrying on their family’s legacy at Bewital Pet Food GmbH & Co. The siblings have witnessed their family-owned firm’s rapid growth following two significant investments in both wet and dry pet food production in 2015.

“We wanted to add very high levels of fresh meat in our dry food,” said Dr. Juergen Wigger, company director at Bewital. “Conventional extruders are not able to process these products.” So the company expanded their dry food plant and built a second extruder line with a twin-screw thermal extruder, a technology specially suited for high-meat applications for dry food. The technology offered other advantages as well, such as gentler treatment of ingredients.

According to Wigger, Bewital is the second company to use a twin-screw thermal extruder, after GA Pet Food UK. Unlike GA, however, Bewital processes all meat directly after buying it from local butchers and slaughterhouses.

The challenge of fresh meat in dry food

In November 2015, Bewital introduced 30 percent fresh meat in all dry foods under their Belcando private label. The company now offers products with up to 50 percent fresh meat and plans to increase this level in the future.

Despite the success of the new production line, Bewital was facing a dilemma. For 20 years, the company had sold moist food under its own label but produced by other companies under Bewital’s supervision. However, in 2015, the market for superpremium moist food in Europe was growing quickly. “Almost all other brands were buying their private label [pet food] from the same sources as we were,” said Wigger. Bewital saw potential within the market for an additional producer of superpremium moist food, so in 2015, the company constructed a second factory for producing moist pet food.

The wet production facility began operation with six employees. The facility now has 21 employees and will be expanding to keep up with demand. | Courtesy Bewital

Since the construction of the new plant, Bewital has been striving to improve the quality of its meat sources, and in September 2016, the company re-launched its superpremium cat food line, Leonardo. Developing cat food with fresh meat took more time than developing new food products for dogs, according to Wigger. “High-quality fresh meat can enhance the palatability of cat food substantially, depending on the combination of raw materials and the type of meat,” he said.

Bewital has been using vegetable ingredients for years, but meat processing has always had roots in the company’s success. “My father supplied quality meat to small and medium-sized local butchers,” said Wigger. “Now, with our own meat preparation, we can buy from regional meat processors without depending on traders or on a few large meat meal producers.”

Transparency with customers and retailers: the key to success

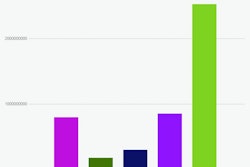

The investments in meat processing have paid off. In 2016, Bewital’s pet food department reached sales of about EUR48 million (US$56 million) and Wigger expects sales to grow between 15 and 20 percent in 2017. To keep up with demand, the company is planning to expand its moist food facility.

The investment is a major success factor, but when asked about Bewital’s growth, Wigger said the company’s first and most important key to success is maintaining transparency with pet parents.

“We have to communicate much more with our customers than before,” said Wigger. “In the 1990s, customers wanted to know the protein content … They now want to know where the meat is coming from and how the animals have been raised.” Bewital offers factory visits and seminars in an effort to answer as many questions as possible. “We have to be transparent to our customers,” said Wigger. “Today success is all about trust.”

Bewital continues to offer products that are growing in popularity among pet owners, such as grain-free products, single protein diets, dry foods with fresh meat and superpremium moist food. The company is hoping to capitalize off of recent growth in the superpremium segment, as more pet owners want higher quality food.

In addition to products, Bewital also offers its customers advice on trends in the market and legal issues. “This combination is highly relevant for private-label customers, who want to offer innovative products and want to develop their own brand identity,” said Wigger.

The EU defines fresh meat as muscle meat, which cannot come from intestines or organs such as the liver or heart. Bewital’s wet pet food plant prepares fresh meat through grinding processes and also does basic internal testing of ingredients. Third-party labs are used for more specialized testing. | Courtesy Bewital

Just the Facts:

Headquarters: Suedlohn, Germany, 90 KM north of Cologne

Facilities: factory for dry food, factory for moist food

Officers: Dr. Juergen Wigger, co-director; and Ulrike Petershagen, co-director

Sales: EUR48 million (US$56 million) in pet food

Brands: Belcando, Leonardo, BEWI DOG, BEWI CAT

Distribution: Germany and 53 other countries

Employees: 112

Website/Social Media: www.bewital-petfood.de

The future of private label brands

According to Dr. Juergen Wigger, company director at Bewital, more and more retailers are focusing on private-label brands.

“Private-label pet food offers opportunities for producers like us,” said Wigger. “The times when private labels were present only in the lower end of the market are gone. In the past you had to choose cheap raw materials and optimize your recipes according to changing prices in order to stay competitive in the market. Now, we see retailers who really care for the quality of their private label. They have their own strategy for their brand and they need high quality producers in order to realize their projects.”

Bewital only sells its private-label brands to independent retailers, but, as in the US, those retailers often face pressure from e-commerce sites. Internet competition in Europe poses a problem for small business because EU law prohibits minimum advertised prices (MAP), often giving large online retailers an advantage.

Bewital has traditionally avoided dealing with online retailers and large pet superstore chains in Europe, such as Fressnapf, because of their loyalty to independent retailers and because they want to avoid becoming too dependent on a chain. However, in 2014 and 2015, the firm agreed to sell products through zooplus AG, a European-based online pet supplies site, and has seen significant growth since then.