The U.S. fresh and raw cat food market shows no single brand dominates organic search visibility, with specialist and premium brands competing across a fragmented landscape, according to a new report from Bubblegum Search.

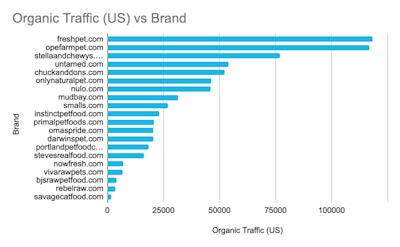

The digital marketing agency analyzed organic search performance of 20 leading fresh and raw cat food brands operating in the U.S. Freshpet leads with 118,000 monthly visits, followed by Open Farm at 117,000 visits and Stella & Chewy's at 77,000 visits, the report found.

Traffic concentration without outright dominance

The top five brands capture approximately 59% of total organic traffic, indicating meaningful concentration while leaving smaller specialists to compete for remaining demand, according to Bubblegum Search.

"The U.S. fresh and raw cat food landscape is led by premium and specialist brands, with some 'overlap' brands performing well, rather than dominant marketplaces," the report stated.

Brand-led versus discovery-focused strategies

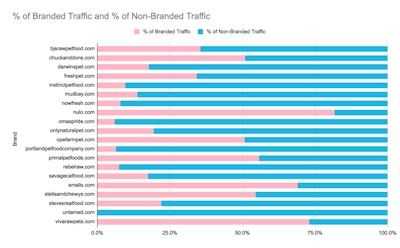

Brand visibility strategies varied significantly across the category. Brand-led players including Nulo (82% branded traffic), Smalls (69%) and Stella & Chewy's (55%) rely heavily on existing brand recognition, while discovery-focused brands such as Untamed (0.1% branded) and Oma's Pride (6%) generate most visibility through non-branded, informational queries, the report found.

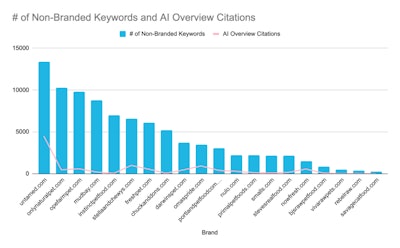

AI Overviews favor content depth

AI-driven search visibility emerged as a distinct competitive layer, according to Bubblegum Search. Untamed leads AI Overview citations with 4,500 mentions despite being UK-based and not serving the US market, demonstrating how educational content depth can dominate emerging search formats regardless of traffic volume, the report stated.

Domain authority and backlink profiles generally aligned with organic traffic scale, though content breadth and relevance consistently outweighed authority alone as primary drivers of organic reach, according to the report. Freshpet and Stella & Chewy's both operate at domain rating 68, while smaller brands like Rebel Raw (domain rating 30) and Savage Cat Food (domain rating 39) showed significantly lower traffic volumes.

Overlapping brands capture largest share

The competitive landscape extends beyond format specialists, the report found. Overlapping premium brands captured 50.4% of organic traffic within the analyzed set, while specialist providers accounted for 31.3% and retailers or marketplaces represented 18.3%.

"Overlapping brands benefit disproportionately from AI Overviews," according to Bubblegum Search. "Their strong informational coverage and broader brand authority translate into outsized citation visibility relative to traffic share."

Keyword breadth separates leaders from competitors

Keyword breadth emerged as the strongest separator between category leaders and smaller competitors, with top brands ranking for significantly more keywords than long-tail players, the report stated. Leading brands averaged 7,940 ranking keywords compared to 506 for the bottom tier.

"In the U.S. cat food market, organic visibility is shaped less by scale and more by content breadth, discovery coverage and AI-ready authority," the report concluded. "Brands that balance branded demand with structured educational content are best positioned to grow as AI-driven search accelerates."