As reported in Packaged Facts’ new study on “Pet Food in the U.S.,” historical usage rates make evident several topline trends in pet food and the handmaiden pet treats category.

Purchasing, usage for dry pet products remain steady

MRI-Simmons data show that purchasing rates for dry pet food, whether for dogs or for cats, remain flat given near-universal usage:

- Usage rates for dry dog food, at 94% of dog food purchasers as of 2022, have held steady in the 92%–95% range since 2005.

- Similarly, use of dry cat food, at 95% of cat owners in 2022, has held steady in the 91%–95% range since 2005.

Usage rates for dog biscuits/treats have also remained very steady, albeit at a relatively lower rate of three-fourths of dog owners.

Growth seen in wet pet food

The longer-term growth has mainly been in wet (canned, cup or pouch) cat food and cat treats. This skew reflects a basic competitive landscape fact: Because the U.S. pet market has long been canine-centric (in contrast to Europe), putting the spotlight on cats is one of the prime opportunities for pet industry growth, in pet products as well as veterinary services.

While use of wet dog food has edged upward, purchasing rates for wet cat food remain significantly higher and are rising faster. In turn, while usage rates for dog biscuits/treats remain higher, use of cat treats has jumped significantly:

- Usage rates for wet cat food jumped from 47% in 2005 to 61% in 2022.

- Use of wet dog food edged up from 34% in 2005 to 41% as of 2022.

- Use of cat treats jumped from 41% in 2005 to 61% in 2022.

Because wet pet food can be dispensed as a treat, these pet food forms flip roles — at least to a degree — in the dog versus cat food categories.

Regular versus specialty pet foods

In tandem and entangled with pet food format competition, which extends further to include fresh (refrigerated/frozen) pet foods and pet food toppers, is the choice between regular and specialty pet food formulations.

Packaged Facts’ April 2022 Survey of Pet Owners shows that only half of dog and cat owners use regular/adult formulation pet food, in keeping with heightened pet owner attention to the specific health needs of their pets.

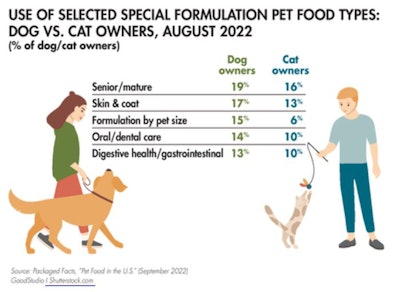

Specialty pet food formulation types are myriad, and individual products are typically positioned on several formulation-based claims — sometimes bewilderingly so. As is consistent with the growing share of dog and cat owners with senior pets, senior/mature pet formulations are among the most popular specialized formulations, used by 19% of dog owners and 16% of cat owners (see Figure 1). Weight management/diet foods — especially relevant to older pets — also rank among the leading types of specialty formulations. By specific pet health condition or concern, skin and coat formulations take the lead, at 17% of dog owners and 13% of cat owners.

FIGURE 1: Many pet owners have taken to looking for specialty formulas for their pets, including a growing senior/mature demand as well as overtly functional options like skin/coat and digestive health.

It’s also noteworthy, as well as paradoxical, that consumers’ specialty pet food choices are not necessarily anchored in veterinary guidance, despite very high veterinary services usage rates (82% of dog owners and 73% of cat owners). The high usage rates for veterinary services, like the heavy use of specialty pet food formulations, speak to the elevated focus of pet parents, in this “pets as family” era, on optimizing their pets’ health and wellness.

2022 pet food nutrition trends: Innovation, functionality