The U.S. pet food market is facing headwinds. As in almost every consumer product category, e-commerce continues to upend traditional retail as more customers opt to buy online at significant levels. For pet food, a side effect has been to speed up the dissolution of the pet specialty/mass channel divide that has long helped to justify the “superpremium” prices of brands sold only by pet specialty retailers. Prestige superpremium brands have for years bolstered dollar sales in the absence of volume growth by converting pet owners to higher-priced fare. Now, however, virtually all pet food brands are available online, accelerating the “mass premiumization” trend whereby the superpremium brands themselves or comparable products are now widely available in the grocery and mass channels.

New directions for pet food growth

With sales flattening, pet food marketers are looking in new directions for growth. One key to increasing or at least protecting sales lies in harnessing tools already in place: e-commerce and customization. By tying these strategies in with specialized diets offering proven health benefits, pet food marketers encourage pet owners to spend more for the sake of convenience, personalization and high-quality nutrition at a whole new level. Individualized meal plans, freshly prepared foods (now available both online and in store) and home-delivered diets are options that are setting the pace for innovations, and pet food marketers can team up with retailers and e-tailers to deliver on all of these fronts.

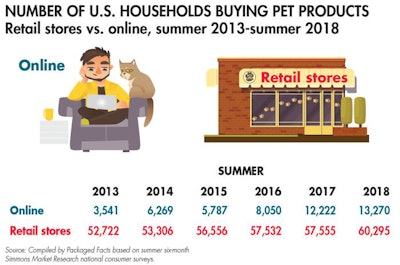

Given the rapid growth of e-commerce in the pet market, the number of households purchasing pet products online grew from 3.5 million in summer 2013 to 13.3 million as of summer 2018, according to Simmons national consumer surveys. Moreover, the number of online pet product households grew by 5.2 million between summer 2016 and summer 2018 compared to growth of 2.8 million shopper households for any type of retail store.

Given the convenience, intensive price competition and “endless aisle” appeal of online sellers, along with the general surge in Internet shopping, it’s not surprising that the internet is outpacing brick-and-mortar stores in customer base growth. What is surprising is that online shopping has been not just cannibalizing existing business but delivering incremental sales growth. For the past few years, the internet has been disproportionately responsible for helping to keep the U.S. pet industry on a healthy upward track (see Figure 1).

FIGURE 1: The online pet food market has seen significant growth since 2013, as more consumers turn to the convenience and options of the digital space.

The effects of pet food safety on purchasing decisions

Moreover, in the aftermath of the 2007 recalls, stringent new pet food safety initiatives were signed into law, including authority for the U.S. Food and Drug Administration (FDA) to order mandatory product recalls, Current Good Manufacturing Practices (cGMPs) for all animal feed facilities, more frequent plant inspections and a zero-tolerance policy for pathogenic bacteria including Salmonella.

For the pet food market as a whole, the impact may be mostly positive, spurring pet owners to trend up to pet food varieties considered to be safer, such as those marketed on claims like natural, organic, limited ingredient, human-grade, Made in the USA, free-from China-sourced ingredients, non-GMO — any and all of the characteristics associated with “clean label” products and greater corporate transparency about sourcing, processing, distribution, local and wider economic and ecological impacts, and company practices and values generally.

Pet food outlook through 2023

With many pet owners having already traded up to higher-priced foods and the pet population static, Packaged Facts new report on Pet Food in the U.S. (14th edition, January 2019) projects that compound annual sales growth will slow to 2–3 percent through 2023. The U.S. market for pet food remains solid, nonetheless, with blockbuster online sales and enthusiastic millennial pet parents as key market drivers — along with mission- and values-driven innovation by pet food manufacturers, retailers and e-tailers alike.