Blue Buffalo’s revelation this week that it may have received poultry by-product meal mislabeled as chicken meal adds an interesting new wrinkle to the ongoing litigation between the company and Nestlé Purina (and the ad wars between Blue Buffalo and Hill’s Pet Nutrition).

According to a letter to Blue Buffalo’s customers posted on the company’s website, the Texas plant of Wilbur-Ellis, an ingredient supplier to the petfood industry, had mislabeled some shipments of poulty by-product meal as 100% chicken meal earlier this year. The supplier has already corrected the problem—and Bill Bishop, founder and chairman of Blue Buffalo, says it is no longer doing business with that plant—but the statement acknowledges that the petfood company may have received some of the mislabeled meal.

While Blue Buffalo almost certainly tests incoming ingredients for potential contaminants (pathogens, mycotoxins, etc.), as nearly every petfood company should and does do, apparently it doesn’t test for content or nutritional values. Though Bishop’s statement does not say this, the implication is that some Blue Buffalo products could possibly have included by-products, as Purina has alleged in its false advertising lawsuit. (Which is doubly interesting because of Blue Buffalo’s earlier retort—and industry buzz—that Purina was using outdated testing methods when it supposedly found by-products in Blue Buffalo products.)

This is all still to be sorted out in the courts or in lawyers’ offices. But perhaps the key reason it came about—starting with Hill’s complaints to the US National Advertising Division—is because of Blue Buffalo’s fast rise in the highly competitive petfood marketplace, as Bishop alleged in his original response to the Purina lawsuit.

Blue Buffalo’s sales increased 11.7% from 2012 to 2013, or US$730.4 million to US$815.8 million, according to Euromonitor data; that followed a 12.8% sales increase for the company from 2011 to 2012. Its ranking in the US and globally is now seventh, rising from 11th in 2011, according to our Top Petfood Companies Database. (The database and ensuing reports will be updated in January 2015 and include some of the 2013 data from Euromonitor.)

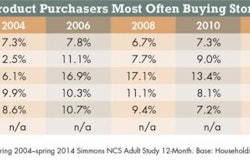

The company’s growing market share probably concerns its competitors even more now because, by many indications, the petfood market’s seemingly nonstop growth has hit a slowdown this year in nearly every region, including the US. During the 2008-2009 global economic recession, the industry saw a dip in growth, but that rebounded starting in 2010. And we’ve seen 3.7% to 6% growth in the US each year since, including 4.7% in 2013, according to Packaged Facts.

However, the market research firm’s latest report, Pet Food in the US, 11th Edition (September 2014), indicates only 1.1% growth this year, with particularly slow growth in mass market channels. Fortunately, petfood sales in other retail channels, namely pet specialty, along with farm/feed and online, are still growing at a healthier rate, and Packaged Facts projects the overall US petfood market to be growing again by 3% next year, followed by 3.5% to 4.5% growth a year through 2018.

This year’s data is backed by anecdotal evidence that some US pet retailers, along with pet product manufacturers, are starting to struggle financially. And this is not just a US problem. The petfood market in Western Europe has been stagnant for a few years now, as many countries in the European Union (including now even the usual economic leader, Germany) are facing slowing or declining economies. Even Brazil, one of the fastest-rising economies just a few years ago, is now struggling, which could slow growth in the explosive petfood market there.

And, in what may be just a coincidence (or may be related to the current economic situation in Brazil), news came this week that Total Alimentos—a longtime petfood powerhouse, one of the top three petfood companies in Brazil and 13th largest petfood company globally—is being acquired by In Vivo NSA, a French agricultural group.

With Total being a privately owned company to date, the only revenue data available to us was from Euromonitor, which pegs the company’s 2013 sales at US$408.1 million, while the In Vivo press release says Total has annual sales of US$220 million. Reasons for the discrepancy are not clear, but it’s worth noting that Euromonitor data has shown Total’s revenues declining for the past two years: -6.4% from 2011 to 2012 and -0.2% from 2012 to 2013.)

This acquisition is just the latest in a series of major activity in the petfood market this year, with perhaps the most significant being Procter & Gamble’s sale of all its petfood brands. This will continue to reshape the competitive landscape but will do nothing to address the slowdown of growth. The only way to combat that, according to market experts like Packaged Facts and an executive from the pet retail sector I spoke with recently, is to grow the market by growing pet ownership, which will take an industry-wide effort and collaboration.

If you have ideas for how to increase pet ownership in the US and around the world, please post them in the comments section below. (You have to be registered and logged in to PetfoodIndustry.com to comment; registration is free.)