Independent pet specialty retailers in the US saw the largest sales increases in dog food, grain-free products and all-natural treats in 2013, according to the 2014-2015 Pet Age Retailer Report. That’s the good news. On the less than positive side, these retailers reported slower growth than the previous year—perhaps setting the stage for the even smaller petfood sales increases experienced in 2014, though that slowdown happened mainly in the mass market channel.

Based on the responses of 644 US pet retailers who answered Pet Age’s Internet-based survey, the report showed mixed growth in pet product sales. While more than 41% of respondents reported some sales growth, only 23% said their store profits had increased 1%-5%; 11% reported no change in sales. On the other hand, more than 49% reported some increase in their gross value of dry goods sales (which includes petfood).

Dog food contributed the best growth performance for these retailers in 2013, with about 15% of survey respondents saying it was their largest growth category. It also was the business mainstay for many of these stores; 28% said the category accounted for at least 50% of their gross dollar volume. About 47% reported their dog food sales increased “slightly” in 2013 and 19% said these sales were up “greatly” (Pet Age’s wording, not defined).

For comparison, 2013 data from GfK, which tracks sales in US pet stores, veterinary clinics and farm and feed stores, showed a 6.7% increase for dry dog food and 7.1% growth for wet dog food. In the Pet Age survey, 19% of respondents reported no change in dog food sales, which matched data for the US mass market channel, especially in 2014, which barely registered growth (0.2% for dog food, according to Packaged Facts).

Grain-free petfood sales, particularly for dog food, continued to increase on a healthy level, though not as strong as in 2012, when it was the largest growth category for US pet retailers surveyed by Pet Age. In 2013, it was the third largest growth category in this pet specialty survey. This slight growth slowdown runs somewhat counter to the picture painted by GfK data; the research firm’s 2013 figures showed a 25.9% rise in grain-free petfood (mostly dog food) in 2013, with another 32.4% increase through May 2014.

Yet the Pet Age report did jibe perfectly with other data in terms of sales of natural treats. For example, survey respondents said natural dog treats comprised their second largest growth category in both 2012 and 2013. Similarly, GfK data for dog treat sales (all treat products) in 2013 showed a 10.3% increase from 2012, while SpinScan data (reported by Packaged Facts) indicated 10.5% growth in pet treat sales in US natural supermarkets in 2013.

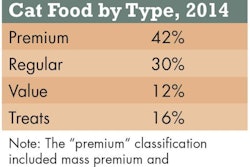

Cat food was not a significant growth category for the US pet retailers in the Pet Age report, but more than 56% reported sales were up slightly or greatly for 2013. These stores do count on this category for business: 20% said it represented at least 20% of gross dollar volume, with another 22% reporting cat food accounted for 10% of their business.

The report’s perspective on cat food sales seems to correspond with that from GfK, whose 2013 data showed only 2% growth for dry cat food in pet specialty stores yet a 5.4% sales increase in wet cat food and a 7.9% rise in cat treat sales. On the other hand, cat food sales overall increased only 0.7% in the mass market channel in 2014, Packaged Facts says.

Regarding food products for other species, the Pet Age report represented a mixed bag: more than 47% of respondents said they saw no change in sales for bird food and supplies; more than 51% reported sales of small animal food and supplies were up slightly or greatly; and 52% of stores stocking reptile food and supplies said sales were up slightly, with another 4% reporting sales up greatly.

The bottom line for the US petfood market: dog food still reigns, with cat food an important second-place supporter, and the pet specialty channel is home to the healthiest sales growth.