While pet food saw remarkable sales and spending growth in 2020—from 10% to 31%, respectively, in the U.S. alone—the market was not immune to the effects of the COVID-19 pandemic. Significant supply chain and distribution disruptions hit hard in some cases and are continuing throughout 2021. Those may have played a role in a downturn for another key measure: innovation.

Globally, new pet food product launches decreased dramatically in 2020, by 67%, according to the Mintel Global New Products Database. The huge decline—from 510 launches in 2019 to 169 in 2020—was shared by Max Davis, business unit manager for Waldner North America’s filling and sealing systems, in a webinar, “From can to cup: How pet food processors can successfully transition.”

Davis described the drop in new product launches as an “almost complete collapse. Typically, in a competitive, fast-growing consumer segment, as sales increase, so do new product entrances, and competitors,” he said. “Much of [the decline] is lag-time related, as new product launches during the height of COVID were extremely difficult to market. Nonetheless, this reads to me as a market begging for more products and significant innovation.”

Product launches took back seat to getting pet food out the door

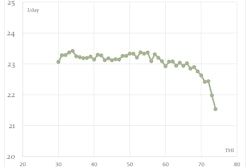

The lag time Davis referred to is at least partially due to those supply chain and distribution issues, along with overall uncertainty about the economy and pet food market specifically. Early in the pandemic, no one could foresee or project how consumers might respond to lockdowns and quarantines, or how financial difficulties might affect their spending. Indeed, an initial spike in pet food sales, driven by stocking up when lockdowns first went into effect in March 2020, was followed by a notable decline.

But spending and sales picked back up, first reaching 2019 levels and then far surpassing them. Many pet food producers struggled to keep up with surging demand, especially in the beginning but also since because of the ongoing supply chain, transportation and labor problems, plus positive factors such as increased pet ownership.

Thus, it’s understandable that innovation and new product launches took a back seat to simply getting existing products made and out the door to retailers and consumers. At the same time, all pet trade shows were shut down, eliminating one major product launch platform, particularly for introducing new products to retailers.

In 2021, Global Pet Expo and Interzoo were both forced to convert their leading trade shows to digital events. Those were effective but not nearly the same as being able to see and inspect the actual products or talk in person with a knowledgeable person from the pet food company.

Packaging innovation in cup sizes and fresh pet food

With Superzoo 2021 happening in person in August, followed by Zoomark in November, it will be interesting to see how many new pet food products are introduced and whether they are truly innovations or just line extensions. Some industry experts have argued that true innovation has been lacking (or at least lagging) for several years now. In fact, though not as big a drop as in 2020, new pet food product launches decreased in by 17.5% in 2019, according to the Mintel database.

With Davis’ webinar topic (and company’s business) focused on packaging, his predictions for pet food innovation involved wet dog food packaging sizes as well as packaging for fresh pet food. For the former, he said that currently, most wet pet food in plastic cups or containers comes in two average sizes: 3 ounces and 13 ounces. “For dog food, I expect a mid-range point to come in that’s around a 7-ounce cup. I haven’t seen it yet, but I am expecting to see it in the near future,” he explained. “I think we’ve seen really explosive growth in the [product] format, but we haven’t seen much innovation in the size and shapes of the packages.”

His comments were specific to the U.S.; he commented that if you are able to visit a brick-and-mortar store in Europe carrying wet pet food, you’ll see a much wider variety in packaging formats.

As for fresh pet food, Davis believes it holds the most promise for packaging innovation, perhaps even as the next generation of pet food packaging. “I think long term, they’re going to have to get away from kind of the sausage-like wrapping that I see it usually packed in,” he said. “I don’t know what the next solution is, but that’s the product line I think where the growth will occur and the packaging innovation will occur.”

Indeed, fresh pet food continues to be a strong growth category: In 2020, sales of refrigerated and fresh pet food increased nearly 21%, according to data from NielsenIQ presented during Global Pet Expo Digital Access 2021, and growth in 2021 is continuing at a nearly 20% clip.