As 2026 begins, pet food industry professionals are taking a measured but largely optimistic view of the year ahead, according to poll results from Petfood Industry.

Overall, the results suggest an industry preparing for steady but unspectacular growth, with companies betting heavily on innovation and marketing while navigating consumer uncertainty and operational challenges.

2026 industry outlook

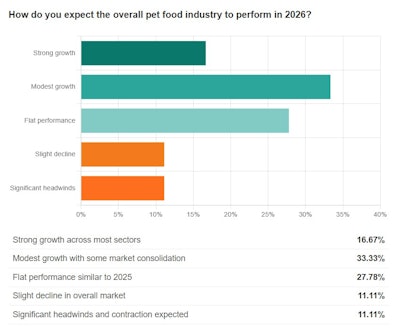

When asked about overall industry performance, respondents showed caution. One-third (33%) predicted modest growth with some market consolidation, while 28% expected flat performance similar to 2025. Only 17% anticipated strong growth across most sectors, while 22% projected either slight decline or significant headwinds.

What this means: Industry professionals expect 2026 to be a year of modest performance and potential consolidation, with only one in six anticipating strong growth and nearly a quarter bracing for contraction.

2026 revenue outlook

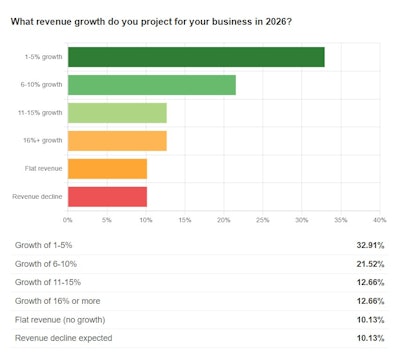

Revenue projections revealed a split outlook, with one-third of respondents (33%) expecting 1-5% growth for their businesses in 2026. Another 22% projected stronger growth of 6-10%, while 13% anticipated even more robust expansion of 11-15% and another 13% expected growth of 16% or more. However, uncertainty remains present, as 10% forecast flat revenue and another 10% anticipated decline.

What this means: While nearly 70% of pet food professionals expect growth in 2026, the concentration in the modest 1-5% range suggests cautious optimism tempered by economic uncertainty and market headwinds.

Investment plans

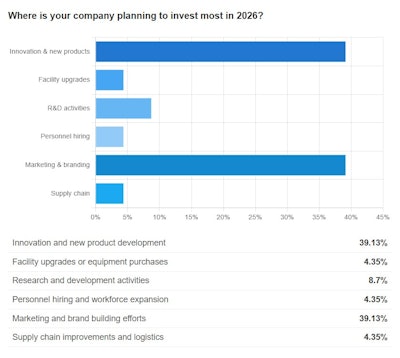

Investment priorities for 2026 split dramatically between two areas. Innovation and new product development topped the list at 39%, tied exactly with marketing and brand building efforts at 39%. Research and development activities garnered 9% of responses, while facility upgrades, personnel hiring and supply chain improvements each received approximately 4%.

What this means: Pet food companies are betting their 2026 success on customer-facing initiatives — innovation and marketing — rather than operational infrastructure, signaling a strategic focus on differentiation and market share in a competitive landscape.

2026 trends

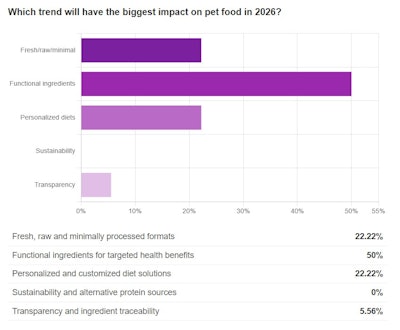

Functional ingredients for targeted health benefits emerged as the clear trendsetter, with half of respondents (50%) identifying this as the biggest impact trend for 2026. Fresh, raw and minimally processed formats and personalized diet solutions each captured 22% of responses, while transparency and ingredient traceability received 6%. Notably, sustainability and alternative protein sources received zero votes.

What this means: The industry's overwhelming focus on functional ingredients over sustainability suggests pet food professionals see health and wellness claims as the dominant consumer driver in 2026, with environmental concerns taking a back seat to performance-based nutrition.

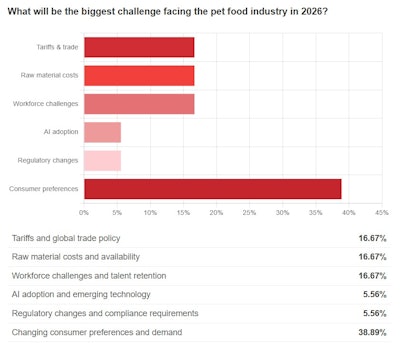

Biggest challenges in 2026

The biggest challenge facing the industry proved more divisive. Changing consumer preferences and demand led concerns at 39%, while tariffs and global trade policy, raw material costs and availability, and workforce challenges each tied at 17%. Regulatory changes and AI adoption each garnered approximately 6% of responses.

What this means: Pet food professionals view unpredictable consumer behavior as their primary 2026 challenge, outweighing operational concerns like tariffs and costs, reflecting anxiety about maintaining relevance in a market where buyer preferences are shifting faster than traditional supply-side challenges.

Survey methodology: Data collected January 5-16, 2026, from pet food industry professionals via the Petfoodindustry.com polling platform.