As we reach the midpoint of 2025, the pet food industry continues to navigate an unpredictable economic landscape marked by shifting consumer behaviors, supply chain complexities and evolving market dynamics. A mid-year poll conducted by PetfoodIndustry.com reveals an industry in transition, with companies adapting their strategies while maintaining fundamental business viability.

The poll ran on PetfoodIndustry.com for two weeks from late May to early June and received a total of 318 responses. This mid-year check-in was designed to capture how companies are performing against their original expectations, painting a clearer picture of where the industry stands as we move into the second half of the year.

Industry performance reflects complex market dynamics

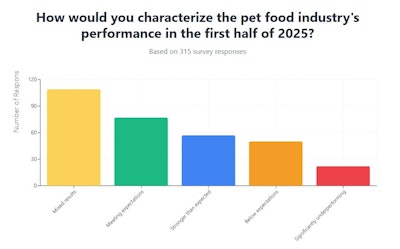

The survey results paint a nuanced picture of industry performance in the first half of 2025. More than one-third of respondents (34.6%) characterized their company's performance as "mixed results," indicating strong performance in some areas while facing challenges in others. This was followed by 24.4% who reported meeting expectations and 18.1% who exceeded projections.

Challenges are evident, however, with 15.9% of companies reporting performance below expectations and 7% significantly underperforming. The data suggests that while positive responses (meeting or exceeding expectations) outweigh negative ones by nearly two to one, the predominance of mixed results indicates a complex operating environment where success varies significantly.

Economic pressures dominate industry concerns

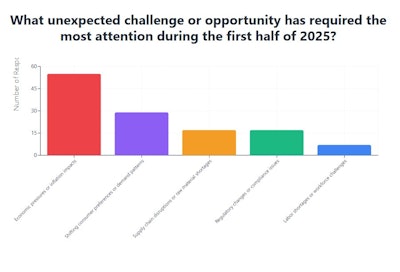

When asked about unexpected challenges requiring the most attention, economic pressures and inflation impacts emerged as the overwhelming concern, cited by 44% of respondents. This finding underscores the continued impact of macroeconomic factors on the pet food sector, with inflationary pressures affecting everything from raw material costs to consumer spending patterns.

Shifting consumer preferences ranked as the second most significant challenge at 23.2%, highlighting the industry's ongoing need to adapt to evolving pet owner demands and purchasing behaviors. Supply chain disruptions and regulatory compliance issues tied for third place at 13.6% each, while labor shortages, though less prevalent at 5.6%, remain a persistent concern.

Together, economic and consumer-related challenges account for more than two-thirds (67.2%) of all responses, indicating that external market forces are driving most of the industry's strategic focus in 2025.

Strategic adaptability without fundamental overhauls

Despite facing significant challenges, the industry demonstrates remarkable resilience in its strategic planning approach. When asked about business plan revisions, 41.5% of companies reported making minor adjustments to their original 2025 strategies, while 28% implemented moderate revisions to key initiatives.

Notably, only 18.7% of companies required major strategic shifts, with 11.9% implementing major overhauls and just 6.8% needing complete resets. An equal percentage (11.9%) reported no changes to their original plans, suggesting their initial strategies remain viable despite market turbulence.

The data reveals that while 88.1% of pet food companies are making some level of adjustments to their 2025 plans, the vast majority (69.5%) are implementing manageable changes rather than fundamental pivots. This suggests that while the industry is actively adapting to first-half challenges, most companies' core strategies remain sound and executable.

Industry outlook: cautious optimism amid uncertainty

The survey results suggest an industry that, while facing headwinds, maintains underlying strength and adaptability. The prevalence of mixed results rather than outright negative performance indicates that companies are finding ways to succeed in some areas even while struggling in others.

The dominance of economic concerns aligns with broader market conditions affecting consumer goods industries globally. However, the fact that most companies are making only minor to moderate strategic adjustments suggests confidence in their fundamental business models and market positioning.

As the pet food industry moves into the second half of 2025, the pet food sector continues weathering economic pressures through strategic flexibility rather than wholesale transformation. The challenge for industry leaders will be maintaining this adaptability while positioning for growth as economic conditions potentially stabilize.