Editor’s Note: This piece, focusing on data and initiatives, is the second in a two-part series highlighting sustainability developments in various segments of the pet food industry.

Sustainability has gotten a lot of coverage in the last several years, first as a buzzword, then as a legitimate trend and now as a movement. Much like the introduction, influence and eventual permanent rooting of the pet humanization trend, it looks as though sustainability is fast morphing into a standard business practice — not just in the pet space, but everywhere consumers have a say in shaping market trends.

Sustainability a disproportionate driver of consumer sales

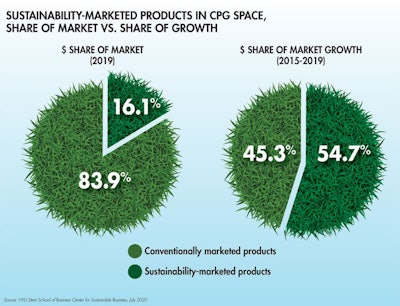

The New York University (NYU) Stern School of Business’ Center for Sustainable Business released updated research in July 2020 focusing on purchasing data when related to sustainability claims across 36 different categories. What their “Sustainable Market Share Index” turned up was interesting: While sustainability-marketed products represented 16.1% of the consumer packaged goods (CPG) market in 2019 (up from 13.7% in 2015), they provided 54.7% of the CPG market growth from 2015–2019 (see Figure 1). Additionally, sustainability-marketed products grew 7.1 times faster than conventionally marketed products and 3.8 times faster than the CPG market overall.

FIGURE 1: Across consumer packaged goods segments, products marketed as sustainable provide a disproportionately large share of market growth, particularly when compared to their relatively small market share.

Two of the 36 categories studied were pet food and pet treats. Pet food products marketed as sustainable grew in sales slightly more than the overall pet food category from 2015–2019, according to the NYU research, but sustainable pet treat sales rocketed past sales for the overall category with over 60% growth (compared to 20% or so growth for the overall category in the same time frame). In fact, in roughly 90% of the categories looked at, sustainability-marketed product sales growth beat the overall category to which they belonged.

The importance of sustainability in the pet food industry

Naturally, sustainability initiatives are a growing part of pet food company business plans. According to Euromonitor International’s July 2020 report “2020 Industry Insights,” sustainability is no longer a “nice to have” component of business; rather, it is now synonymous with business empathy, purpose and resiliency. For segments dealing with food, including pet food, sustainability is multi-faceted and provides many opportunities to embody those traits.

“DSM believes that sustainable food systems are of vital importance to the world,” said Christie Chavis, vice president at DSM Animal Nutrition and Health. “Today’s food production has a large environmental footprint. For example, animal farming is estimated to account for 14.5% of humanity’s greenhouse gas (GHG) emissions (according to a 2019 report published by the Food and Agriculture Organization of the United Nations). With the increasing demand for animal-protein-based foods and our need to keep global warming below a maximum of 1.5°C above pre-industrial levels by 2050 (according to a special report published by the Intergovernmental Panel on Climate Change), this means we need to find ways of substantially reducing the industry’s footprint. Many dog and cat diets contain animal protein derived from farming animals and just like the drive to more sustainable animal proteins for human consumption, so too is there a drive for the same in pet foods — the two are linked.”

To succeed in a more permanent way when it comes to industry sustainability, working together at all levels to achieve the same goals will be key.

“Sustainability is critical to ensure not only the availability of quality ingredients in the supply chain, but also a healthy environment for our families and pets to enjoy together,” said Jack Scott, vice president of sustainability and responsible sourcing for Purina. “Purina is actively driving change toward a more sustainable future within our own operations and within the ingredient supply chains from which we source. To accomplish this, collaboration is key. That’s why we work with partners and like-minded organizations that have similar sustainability goals and missions, so together we are helping to create a more sustainable food system. As a leader in the pet care industry, it is important that we also lead the sustainability of the entire food system for our pets and the people who love them.”

The sustainability of sustainability will take industry and consumer buy-in, as well as some amount of streamlining to continue business operations the way they need to be run for success.

“Ultimately, efficiency is key to sustainability,” said Elizabeth Barber, executive vice president for the F.L. Emmert Company. “Efficiency will be more important than ever before. We’re all looking for products and ingredients that do double duty, as well as processes that can be simplified and condensed. Expect to see a focus on efficiency in 2021 and beyond. Also, a worldwide pandemic shifts priorities. When international supply chains were shut down, companies and consumers started caring more about domestic sourcing. They also became more aware of protecting health proactively. This will affect buying habits for years to come.”

To that point, Euromonitor conducted a “Voice of the Industry: COVID-19” survey in April 2020, where 45% of surveyed companies said they believe that the attention paid to how companies treat employees and consumers during the COVID-19 pandemic will become permanent during future crises, and 33.5% of surveyed companies said they plan to invest in employee health and welfare to prevent risks similar to COVID-19 in the future. It all plays into the idea of “purpose over profit,” an evolution of the sustainability trend that Euromonitor said in its July 2020 report “is a more holistic approach aiming to create social, environmental and economic value.”

Fortunately, the pet industry seems to lean in that direction already, making current and future initiatives (see sidebar: Sustainability initiatives in the pet food industry) a natural extension of the way everyone has already been doing business.

“I’m always blown away by our industry’s shared passion for animal health,” said Barber. “We’re generally people who care deeply about creating great lives for pets, and we work across company and brand lines to make that happen.” It’s not surprising that the leap from pets to the rest of the world isn’t so much a jump as a single step forward.