Harriet Ritvo’s “The Animal Estate: The English and Other Creatures in the Victorian Age” (Harvard, 1989) ushered in academic analysis of pet ownership attitudes in relation to class structure. The more things change, the more things stay the same, you could say of the pet market — but the devil is in the details.

Past and current pet ownership patterns

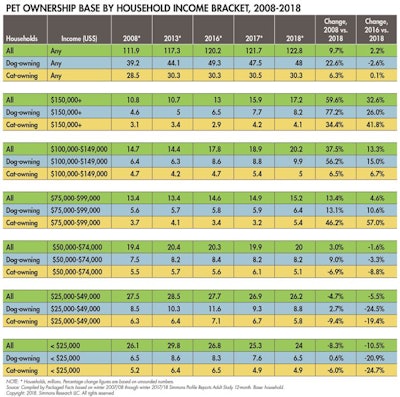

Pet ownership patterns are at an economic crossroads. As reported in Packaged Facts’ Pet Market Outlook (May 2018), the percentage of households with dogs or cats hovered around 50 percent of the US population from 2008 to 2010. For 2011 onward, the percent with dogs or cats edged up to the 52 to 54 percent range (see Table 1).

TABLE 1: While the upper economic income brackets mostly continue to grow their pet ownership, those making less than US$50,000 seem to be increasingly choosing not to own a pet, perhaps pointing to a lack of affordable pet food options in the golden age of premiumization.

The percentage of households with dogs was responsible for that pattern, notching up from 35 to 36 percent for 2008-2010 to 38 to 41 percent in the years since. In contrast, the percentage of households with cats has hovered around 25 percent over this 10-year period.

The most recent Simmons survey suggests a telltale wrinkle in what had become the new normal. After reaching a peak rate of 41 percent in 2016, dog ownership notched down to 39 percent for 2017 and year-to-date 2018, while cat ownership rates did not budge from 25 percent. So dog and cat ownership rates overall now seem flat.

In absolute terms, factoring in population growth, the number of dog-owning households jumped remarkably from 39 million in 2008 to a peak of 49 million in 2016, before downshifting somewhat to 48 million. Despite some fluctuation, the number of cat-owning households has remained at around 30 million throughout this period.

Pet ownership through the lens of household income

Looking at pet ownership by household income levels provides a revealing perspective on the current flattening out of overall pet ownership numbers. The good news is that, compared with 10 years ago, dog and cat ownership is up across the board among households with incomes of US$75,000 or more.

Moreover, this growth is strongest among households who own dogs, the more expensive pets to keep, and who are at the highest household income level of US$150,000 or more. Between 2008 and 2018, according to Simmons data, this cohort grew from 10.8 million households to 17.2 million, with much of the growth in the last few years. In terms of cat ownership, the recent growth spurt has been among households in the solidly middle-class income range of US$75,000–$99,999. These findings support the ongoing premiumization of pet products and services, which is being fueled by “pet parenting” mindsets and correspondingly wide-range attention to pet health and wellness concerns.

The bad news is that, in the past few years, dog and cat ownership is down among households with an income below US$50,000. This downward trend is especially sharp — and longer-term — for cat ownership. Even factoring in population growth, the number of cat-owning households is lower now than it was 10 years ago across the three lower household income levels: under US$25,000, US$25,000-$49,999 and US$50,000-$74,999. These findings point to the ongoing market need for quality but affordable pet care products, including through discount channels and private label — because the human/pet bond isn’t just for stately homes.

The latest pet food market insights

www.PetfoodIndustry.com/authors/145

Packaged Facts’ U.S. Pet Market Outlook 2018–2019

https://goo.gl/GXW4KG